Investors in China have been disappointed over the past month.

The Shanghai Stock Exchange Composite Index (SSEC) gained more than 7% in June – beating the impressive 6% gain in the S&P 500 (SPX). Chinese investors were looking forward to that out-performance continuing in July. But, it didn’t happen.

As of yesterday, the S&P 500 is up 1.63% on the month. And, the SSEC is down more than 3%.

China’s stock market has given back nearly half of June’s impressive gains. It has deflated the optimism of the China bulls. And, the China bears are salivating in anticipation of a stronger decline.

But, for the first time in several months… China looks bullish to me.

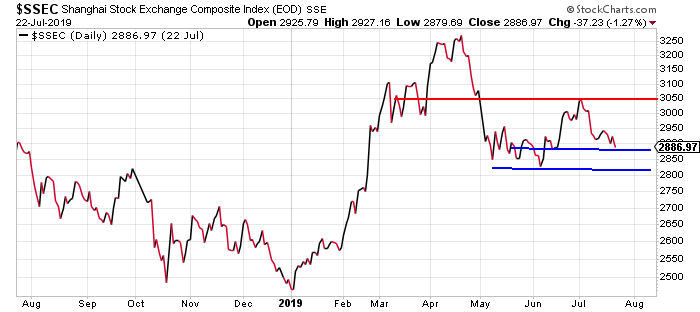

Look at this chart of the SSEC…

In June, the SSEC broke out to the upside of a brief, month-long consolidation pattern (the blue lines on the chart). The index ran all the way up to 3050, where it hit resistance and started to pull back. Now, the SSEC is testing its breakout level – and former resistance line – as support.

If support fails here, then the SSEC will likely head lower and retest the 2800 level. A break below 2800 would spell real trouble for China’s stock market. So, traders could buy the SSEC at about 2890 and put a sell-stop at about 2790. That would limit any potential loss to about 3.5%.

If support holds, though, and the SSEC heads higher, then the minimum upside target would be the late June high of 3050. And, if it can break above that level, then the April high of 3250 comes into play.

That would be a gain of better than 12%.

In other words, buying China right now means traders are risking $1 for the chance to make more than $3.

That looks like a pretty good bet.

Best regards and good trading,

Jeff Clark

P.S. Just a quick reminder before I let you go…

My colleague Jeff Brown is about to unveil a unique trading strategy, and it’s unlike anything I’ve seen before.

As you folks know, I’m no Silicon Valley insider or tech investor like Jeff… I’m a trader. And I don’t pass anything along unless I think it’s worthwhile. But, Jeff knows what he’s doing – and has a 95.3% personal success rate to prove it.

I put together a quick video for you to explain everything. Click here to watch it now.

Reader Mailbag

Today, a subscriber agrees with Jeff’s Mother Indicator…

I chuckled at your mom indicator. I, too, had a mom indicator. Actually, it was a mom-in-law indicator. In 1987, September 15 to be exact, she wanted to know how to buy stocks. At first, I was willing to explain the process to her, until I realized that this was someone who had never shown any interest in the markets. At that moment, the light bulb went on and the rest is history, as they say.

Through the years, the mom-in-law indicator would pop up and continue to be right on with its extraordinary timing. My second mom is no longer here. I do miss her. Your article got me thinking about her and wondering what she might be asking me about today. Thank you for all you do.

– David

Thank you, as always, for your thoughtful insights. We look forward to reading them every day. Keep them coming at [email protected].