There’s nothing like a good hurricane or two to mess up a decent technical pattern.

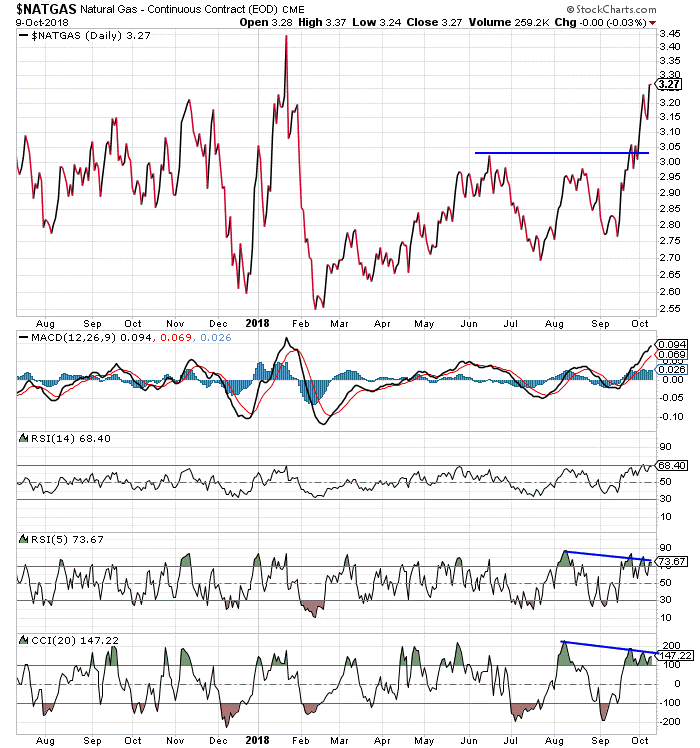

Two weeks ago, I wrote a bearish essay on natural gas. The price of natural gas was bumping into resistance at about $3.05 per million British thermal units (MMBTU). Television talking heads were screaming, “It’s a breakout!” They were calling for sharply higher natural gas prices by Halloween.

I disagreed. I argued that the chart of natural gas was showing negative divergence on a few technical indicators, and that the seasonal patterns were turning bearish. The price of natural gas often declines in October. So, I argued that natural gas prices would likely be lower by Halloween.

So far, I’m not looking too good on that call.

The price of natural gas has exploded higher. Take a look…

The price of natural gas has rallied nearly 9% over the past two weeks.

The weather has a little something to do with this move. The threat of hurricanes in the Gulf of Mexico has caused supply concerns.

Hurricanes trump technical analysis.

Nonetheless, I’m wrong on this call. The talking heads were right. So, I’ll eat the required serving of crow… this time.

I will point out, however… there’s still negative divergence on a couple of technical indicators. We’re still in a seasonally negative period for natural gas prices. And we still have three weeks before Halloween.

So, who knows how this will ultimately play out?

I don’t want to be short natural gas in the face of this strong move higher. But, given the overbought technical setup on the chart, the negative divergence, and the bearish seasonal factors… I wouldn’t be long natural gas here either.

Traders should probably look elsewhere for trading opportunities.

Best regards and good trading,

Jeff Clark

Reader Mailbag

Are you long or short natural gas? Do you see any major changes happening before Halloween?

As always, send us your trading questions, stories, or suggestions right here.