Amid the intense rise in commodities over the last few months, gold has underperformed dramatically. Since August of 2020, copper, platinum, and palladium are up 48%, 32%, and 10% respectively, while gold actually dropped 10%.

Gold is widely considered as a hedge against inflation. But, even though the market is starting to wake up to the reality of rising inflation, gold hasn’t been able to find a bid.

Inflation and rising interest rates go hand in hand… Yet, rising interest rates have a negative effect on gold prices. This has been the single most important factor in keeping gold down since its high in early August.

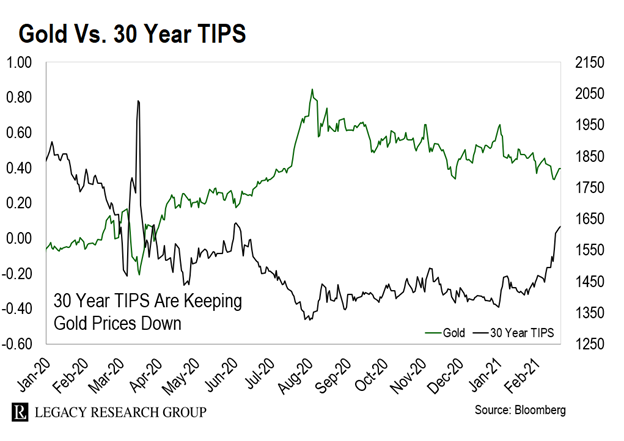

Take a look at this chart of gold versus 30-year Treasury Inflation Protected Securities (TIPS)… A widely used proxy for real time inflation expectations.

My personal preference for using the 30-year TIPS instead of the usual two- or 10-year is because gold is more sensitive to rates in the backend of the curve – and those rates are better indicators of the underlying health of the economy. The chart above shows that near-perfect negative relationship between interest rates and gold… So owning gold as an inflation hedge doesn’t make much sense… But owning gold as a hedge against a weakening dollar, does.

There are dual forces at play when it comes to gold. The dollar plays just as crucial of a role as interest rates.

You see, while rates have been rising, the dollar has been weak.

And, historically, gold and the dollar have been negatively correlated. Gold tends to rise as the dollar declines. This is one reason many gold bulls are calling gold undervalued.

Over the last 10 years, for example, monthly returns in the dollar above 1% would translate to 1.6% losses for gold. And on the flip side, when the dollar would fall more than 1%, gold would rise by 2%. Currently, the dollar index is at a three-year low with investor consensus leaning even more negative on its prospects.

These two market forces dominate gold prices interchangeably and, to a large part, that’s driven by market sentiment. Is that sentiment about to change? Based on gold’s recovery the last few days, it just may have.

Gold recently found major support at the 50% retracement level of its 2020 range… And, unlike the last time it bounced from there, key fundamental and sentiment indicators are making it look attractive.

Whether you’re looking at the historic relationship gold has with the dollar, or just a good low-risk technical set up in prices, gold has upside.

Betting on gold’s upside from current levels would be a good way to take advantage of a rare confluence where both gold and the dollar are cheap. The risk becomes an implicit bet that interest rates reverse course.

That might be difficult with commodities blazing forward… A $1.9T stimulus bill around the corner… And the economy growing rapidly from the last round of easy money.

Given the setup, it seems the market has established a floor for gold prices, which means these prices will not remain where they are for long.

There are a few different options for gold exposure. The simplest way is to own the SPDR Gold Trust ETF (GLD). Mining ETF’s are a great way to pick up dividend income while getting gold exposure. VanEck Vectors Gold Miners (GDX) has the extra benefit of having foreign-owned miners in its portfolio, which is a boost for performance during a weak dollar environment.

|

Free Trading Resources Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |

My preferred method is to always own gold and dynamically hedge away macro risk from interest rates or the dollar – depending on the market environment. In this case, more advanced traders can achieve that by buying in-the-money puts on an ETF called the iShares TIPS Bond ETF (TIP).

Regards,

Eric Shamilov

Contributing Editor, Market Minute

P.S. With all the recent headlines about bitcoin, it may seem like gold is getting left behind, but Jeff Clark knows that in times like these it pays to be contrarian… Especially with gold.

That’s why for his Delta Report members he recommended gold picks that he believes are now perfectly positioned for a move higher…

So, don’t miss out on when gold could take back the headlines, and click here to learn more about Jeff’s gold techniques.

Reader Mailbag

Are you reconsidering buying gold now that better conditions are in place? Or, are you still hesitant about how gold will perform?

Let us know your thoughts – and any questions you may have – at [email protected].