Volatility has collapsed.

Heading into October, the Volatility Index (VIX) was trading above 20. It was approaching its highest level of the year. Folks were starting to panic.

What a difference one month makes…

On Friday, the S&P 500 closed at a new all-time high. Meanwhile, the Volatility Index closed near 12. That’s near its lowest level of the year.

Investors are comfortable. Maybe too comfortable.

Remember, the Volatility Index is considered as the market’s “fear gauge.” It uses the premiums on out-of-the-money call and put options on the S&P 500 to calculate the expected 30-day volatility for the index.

When traders are scared, they’re willing to pay more for options – and the VIX rises. When traders are complacent, traders aren’t concerned about volatility – and the VIX falls.

And, at extreme levels, the VIX can be an excellent gauge of investor sentiment – which makes it an outstanding contrary indicator.

Look at this chart of the VIX…

The VIX traded down near 12 two previous times this year. On both of those times, the S&P 500 was trading at new all-time highs. And, both of those times, the index was sharply lower a few weeks later.

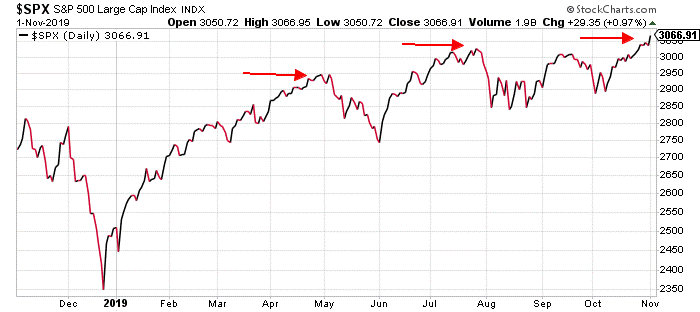

Here’s how the S&P 500 looked during those times…

The S&P 500 was trading near 2950 in mid-April. It lost 200 points over the next six weeks.

In late July, the index closed above 3000 for the first time ever. It was at 2850 one week later.

Of course, just because the VIX is low doesn’t mean it can’t go lower. And, it doesn’t mean the market can’t go higher. But, with the VIX trading near 12, it doesn’t cost much for traders to buy a little “insurance” in the form of put options.

That would have been a smart strategy back in mid-April and in late-July. It may prove to be a smart strategy right now as well.

Best regards and good trading,

Jeff Clark

Reader Mailbag

Today a subscriber shares why Jeff is “a breath of fresh air” …

Hi Jeff,

I’ve been a subscriber since May of this year, and it has been a fantastic ride. Thank you for your expertise in the world of options and the market.

But more importantly, to me anyway, thank you for your humility. You’re a breath of fresh air and I know this attribute is a big reason you’re most popular among other folks.

– Ross

Thank you, as always, for your thoughtful comments. We look forward to reading them every day. Keep them coming at [email protected].