It’s all about the dollar.

The U.S. Dollar index (USD) put on a pretty spectacular rally from its mid-May low to its late August high – gaining about 5%, which is a spectacular move for a currency.

Since then, though, the buck has been smacked down a bit…

And, while it has rallied over the past few days, it sure looks to me like the next big move is lower.

Take a look at this chart of the dollar index…

The U.S. dollar peaked in mid-August when it ran into resistance at the March high.

Since then, the buck has been falling…

The dollar broke below the support of all of its various moving averages, and it declined to its late July low near 92. It has bounced over the past week. And now, the dollar is challenging the 92.50 resistance level – where all of the moving averages have come together.

From my perspective, this is an ideal spot to short the buck.

The moving average lines are declining. The 9- and 20-day exponential moving averages (EMA) are on the verge of completing a bearish cross below the 50-day moving average (MA). And, with this sort of resistance overhead, the path of least resistance is lower.

|

Free Trading Resources Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |

And, if the dollar is headed lower, then all of the anti-dollar trades should be headed higher. That’s a bullish sign for gold and silver.

Granted, gold has just about destroyed anybody who held a bullish view of it over the past year. The metal is down about 5% for 2021 – while just about every other asset class is up double digits.

But, if the dollar turns lower from here, then gold should pop higher. And, as bearish as the dollar chart looks, the gold chart looks bullish.

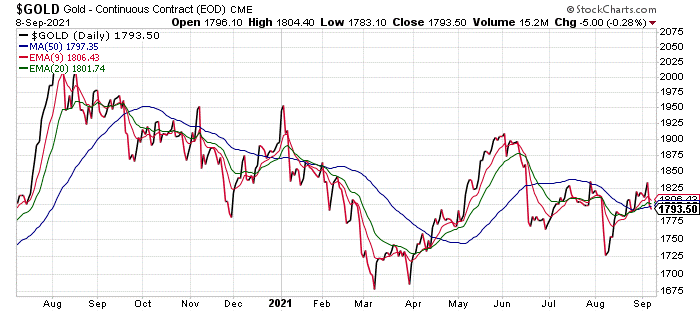

Just take a look…

Gold bottomed in mid-August at about the same time as the dollar peaked. And, as the dollar fell, gold rallied back above all of its various moving averages.

And, those moving averages crossed over into a bullish configuration – with the red 9-day EMA above the green 20-day EMA, and the 20-day EMA above the blue 50-day MA.

The metal has fallen back this week as the dollar has rallied. It’s now sitting right on the support of its 50-day MA.

So, with the dollar running into resistance and with gold sitting on support, this looks to me like an ideal place at which to buy gold. The downside to buying gold looks limited from here, while the upside could be substantial.

There aren’t any guarantees with the market… But, this bullish setup in gold and the bearish setup in the dollar looks about as good as it gets.

Best regards and good trading,

Jeff Clark

P.S. Last night, my colleague and legendary hedge fund manager Larry Benedict held a presentation where he revealed a little-known phenomenon that’s quickly approaching the markets…

During the event, he went over the best way to use this short window in the markets to earn big profits… and even gave away a free ticker to show you how to get started…

If you missed it the first time, you could still watch it, but not for much longer. So, make sure you watch the replay right here.

Reader Mailbag

Do you think this is a bullish setup for gold and silver? Will you be buying gold now that the setup looks like it’s getting ready to pop higher?

Let us know your thoughts – and any questions you have – at [email protected].