As the market keeps churning relentlessly higher into the new year, the talking heads on financial television are acting like there’s no end in sight – even criticizing anyone that dares to take a bearish stance.

So far, they’ve been right. But, as you’d probably guess… I’m still daring.

Market conditions have gone from overextended… to just ridiculous. Tesla (TSLA), as one example, has run as high as 26% in the past two weeks alone. Other trendy names like Beyond Meat (BYND) have done even better, running up as much as 56% in the same time.

Even established tech behemoths like Apple (AAPL) have made ridiculous moves so far this year. It’s gained over 5% – a massive move for a company of its size – and is coming close to a market capitalization of $1.4 trillion.

This rally just isn’t sustainable. But, investors keep pressing. They’re buying the highest-flying tech companies, eager to squeeze out just a few more percentage points of gains.

But when the market inevitably turns down, those high-flyers will be the first and fastest to return to earth. Folks buying those companies now will get crushed.

That’s why my eye is on something completely different right now. Something I think could outperform all of those companies this year…

I’m talking about value stocks. Specifically, Tupperware Brands (TUP).

I know what you’re thinking… It’s hard to find a stock more “boring” than a company that makes plastic bowls.

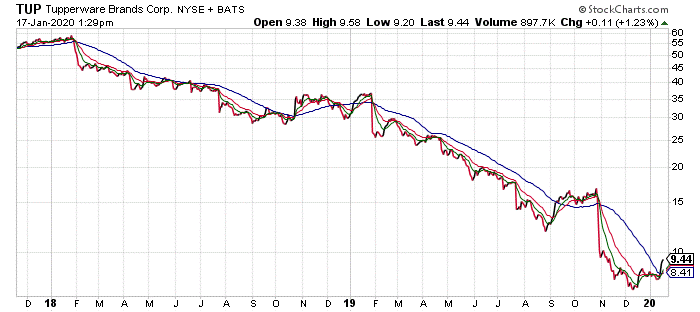

And, at first glance, its chart doesn’t seem like much to look at…

TUP, being such a “boring” stock, hasn’t benefited from the market’s risk-on attitude of the past couple years. It’s floundered from a high of around $60 per share at the end of 2017… to just over $9 per share today.

That might be surprising to you. After all, Tupperware has been a staple in American kitchens for over 70 years. On its face, it seems like one of those “sleep well at night” stocks that you buy once and never have to worry about.

But, over the past two years, the market has rewarded the riskier stocks over the safer ones. The lower the share price of TUP goes, it becomes increasingly less likely that any buyers will step up.

And, not too many stocks have had a worse 2019 than TUP. The final two months of the year were particularly brutal.

In late October, TUP issued an earnings report that fell short of expectations. The company also lowered guidance for the fourth quarter and the full year. The stock fell 10% on the news.

Then, in early November, TUP eliminated its dividend. The stock fell another 5% on the news.

Then, in mid-November, the company’s CEO stepped down. TUP dropped another 3%.

The stock finished the year at about $8 per share – up slightly from its low. And, at the lowest price since the “financial crisis” bottom in 2009.

So, why is this stock on my radar?

As I said, TUP was trading near $60 per share at the end of 2017. At that time, the company was generating its most revenue ever – $2.26 billion.

When 2019 results are reported, TUP will likely have generated $1.86 billion for the year – a decline of about 18% from 2017 levels.

But the stock is down 80% from where it was trading in late 2017.

To me, that decline seems excessive. At writing, TUP trades for less than four times this year’s expected earnings. That seems like an excessively cheap price.

And if you zoom in on more recent action on the chart, you’ll see that TUP has made a key move that points to higher prices ahead…

The price of TUP has made both a higher low and a higher high in the past week. That’s a good sign that the stock has bottomed, and may shift to an intermediate-term uptrend.

Even better, that higher high boosted TUP above all of its various moving averages – which is bullish. And, it appears the shorter-term exponential moving averages (red and green lines) are now poised to cross above the 50-day moving average (blue line). This sort of “bullish cross” often marks the start of a new rally phase.

I think the bottom is in for TUP. And it’s one of my favorite cheap stocks to buy right now. It has a long way to run to reach even half of its all-time high. And, as I’ve been saying in these pages, I think the market’s current appetite for risk will soon shift to an appetite for value – and quickly.

But as you know, I’m a trader. While I think buying shares of TUP is a pretty low-risk move right now, I’m much more inclined to trade the stock – reaping big gains over and over again.

That’s why, yesterday, I made it part of my Three-Stock Retirement Blueprint. I think there will be plenty of opportunities for my readers to trade TUP profitably in the months ahead – capturing far more in gains than they ever would by just buying and holding.

Best regards and good trading,

Jeff Clark

P.S. On Thursday evening, I recommended our first trade on TUP to readers of my introductory options trading service, Jeff Clark Trader.

As I told them, I think this trade has the potential to quadruple your money – along with another trade I provided.

It’s not too late to get into position on this trade. If you want to access my specific guidance on the best way to trade TUP right now, click here to learn more about a subscription to Jeff Clark Trader.