I’ve never seen something quite like this before.

The stock market rallied to a new all-time high on Friday. But… it’s actually oversold.

Let me explain…

The S&P 500 closed within spitting distance of 3400 on Friday. That’s its highest level ever. Most investors probably headed into the weekend feeling pretty good about things…

Unless they checked their account balances on Saturday morning.

Most stocks were lower last week. On Friday, for example, only 44 of the 3,068 stocks traded on the New York Stock Exchange hit new highs. On the Nasdaq, which also closed at a new high on Friday, only 29% of the stocks closed higher on the session.

So, unless you only own shares of Apple (AAPL) – which were responsible for nearly all of the market’s gains last week – you might be looking at your account and wondering “What new highs?” The rest of the market has been selling off and is now oversold.

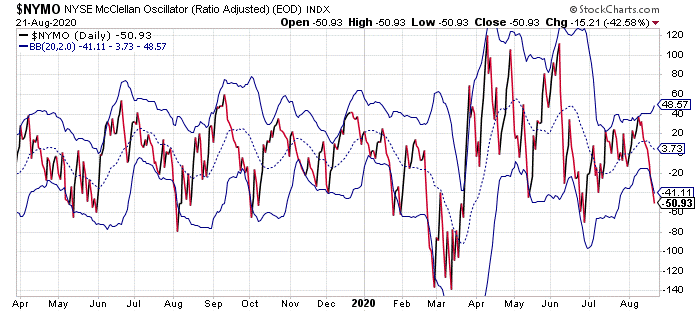

Take a look at this chart of the NYSE McClellan Oscillator (NYMO) plotted along with its Bollinger Bands (BB)…

The NYMO is a momentum indicator that helps measure overbought and oversold conditions. As a general rule, whenever the NYMO moves outside of its Bollinger Bands, it indicates an extreme condition that often reverses within a few days.

For example, when the NYMO trades above its upper BB, the market is overbought and vulnerable to at least a short-term decline. When the NYMO trades below its lower BB – as it did on Friday – the market is oversold and due for a bounce.

So, investors are facing a unique situation right now – where the stock market is trading at its highest level ever… and it’s due for an oversold bounce.

Let’s just chalk this up to another one of those things the market is doing this year that nobody has ever seen before.

But what does it mean? Honestly, I have no idea – we’ve never seen this condition before.

But, if you forced me to guess, I’d say stocks that performed poorly last week are likely to bounce a bit this week. And, the stock that performed the best, AAPL, is likely to give up some of last week’s gains.

Best regards and good trading,

Jeff Clark

P.S. There’s no doubt, the market has made some unusual moves this year. And, at the same time, new investors are jumping into the market in droves…

When I realized this a few months back, and noticed that my son Carson was showing some interest in learning to trade… I decided I had to step in to make sure he got the best education possible.

That’s why on August 26 at 8 p.m. ET, I’m putting Carson through a trading crash course at our kitchen table. I’ll teach him everything that allowed me to retire 25 years early from trading the markets. And, he’ll use that information to try to double his money on a single trade.

And, of course, we’re broadcasting the event live for anyone who wants to learn my trading techniques.

Plus, during the presentation, I’ll give away a free trade recommendation so you can see for yourself how powerful options can be. Just click right here to sign up.

Reader Mailbag

Our mailbag has been a bit light lately. How has your trading gone for the past few weeks? Are you looking to buy into stocks at these levels, stay on the sidelines, or bet on another big fall?

Let us know your thoughts – and any trading questions you may have – at [email protected].