Energy stocks led the market higher yesterday.

The S&P 500 gained 1.7% on Tuesday. Meanwhile, the Energy Select Sector SPDR Fund (XLE) – an exchange-traded fund composed of energy stocks – gained 3.5%. That’s over twice the return of the major indexes. And it trounced the performance of the banking sector – which seems to be just about everybody else’s favorite group right now.

Most important, though, is that yesterday’s energy stock rally looks like just the start of an intermediate-term move higher.

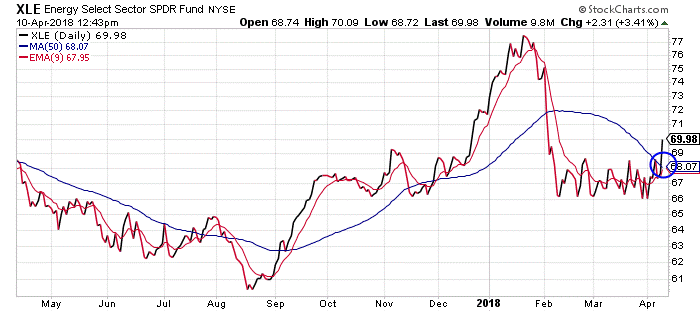

Take a look at this chart of XLE…

After the sharp decline in early February, XLE spent several weeks chopping back and forth in a tight trading range. That action allowed the 50-day moving average (MA) enough time to decline closer to the stock’s price.

That set up the potential for XLE to rally and break out above the 50-day MA. That, of course, is what happened yesterday.

Notice also that the 9-day exponential moving average (EMA) is on the verge of crossing above the 50-day MA. This “bullish cross” often marks the start of an intermediate-term move higher.

And it’s this exact setup that convinces me that energy stocks will lead the market higher for the next several weeks.

You see, most other sector charts don’t look anything like XLE. Most sector charts still have some work to do before they look bullish.

For example, here’s the chart of the Financial Select Sector SPDR Fund (XLF)…

The 50-day MA is still too far above the current price of XLF to set the stage for a breakout move. And, the 9-day EMA is too far away from forming a bullish cross.

Granted, if the market does indeed rally from here for the next several weeks – as I expect it to do – banks and most of the other sectors will do just fine. But energy stocks are likely to be the top performers.

Traders should take advantage of any weakness in the energy sector over the next few days as a chance to buy.

Best regards and good trading,

Jeff Clark

Reader Mailbag

Today, a couple notes from Delta Report subscribers…

Jeff, I have only been a member for three weeks. Based on your ideas, I bought XOM calls and sold DHR puts. These two trades have covered the cost of your service for the next decade. Thanks.

– Peter

I have been wanting to learn. Learn how, what, when, why, where about trading. You are a real blessing for me. Please don’t think you are wasting your time, your knowledge, and your passion for trading in helping those of us who want to learn.

I read in a stock magazine that trading is not a casino. I don’t know who said that or how you feel about that but I think whoever said that is nuts.

Thank you for showing us what to look for, what it means, and what to look for next. Thank you, Mr. Clark.

– Ann

Thank you, as always, for your thoughtful letters and insights. Keep them coming right here.