The stock market often has a volatile reaction to the monthly jobs report. And today’s jobs number might be the most important number we’ve seen in 10 years.

Let me explain…

There is a strong correlation between the stock market and the unemployment rate. As the unemployment rate falls, the stock market tends to rise. And vice versa.

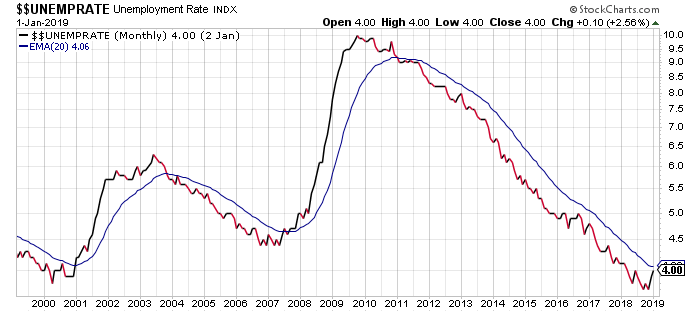

Take a look at this chart of the unemployment rate along with its 20-month exponential moving average (EMA)…

If you look at the action in early 2001 and in late 2007, you’ll notice the unemployment rate popped above its 20-month EMA. And, if you have a good memory, you might also remember what happened in the stock market shortly after those moves in 2001 and 2007.

For the past 10 years, the unemployment rate has been declining. And, for the past 10 years, the stock market has been rallying.

But, if you’ll notice, the unemployment rate spiked a little bit higher last month. We’re at 4% unemployment – which is a ridiculously low number and suggests our economy is firing on all cylinders.

The spike higher, though, is a bit of a concern.

The rate didn’t pop above the 20-month EMA last month. But it sure looks poised to do so today. And if it does, then the prospects for the stock market for the rest of 2019 turn bearish.

Rising unemployment is strongly correlated with a falling stock market.

So, if today’s jobs report shows an increase in the unemployment rate above 4.1%, then all I can tell you is “SELL.” Stocks are headed lower.

If the unemployment rate dips down again, then the stock bull market has a little more life to it.

Best regards and good trading,

Jeff Clark

Reader Mailbag

Do you think 2019 is going to turn bearish? Or do you think the bull has a little more life to it?

As always, send any other trading stories, questions, or suggestions to [email protected].