Two weeks ago, I did something that I rarely do. Something painful.

I shorted gold stocks. I even told my Jeff Clark Trader subscribers to do the same.

And, as painful as it was, we made 100% in just a couple of weeks…

Today, I’ll show you how.

I’m not a gold expert. But, I am a gold bug. I’m not shy about my affinity for the shiny yellow metal. It’s one of the few long-term holdings that I consistently add to.

The reason is simple…

I don’t trust the financial markets. There’s simply too much individual, corporate, and government debt – and much of it can’t ever possibly be repaid. And that keeps me skeptical and cautious on the current bull market.

The bull market will end eventually. It will end badly. And, it will end at the hands of this monstrous debt load.

Gold is a safe haven from the stock market. Investors rush to it when things turn scary. And, even with this year’s bull run – which has actually outpaced the stock market – all investors should have some gold in their portfolios.

That all being said… The recent gold rally was simply too much, too fast. Gold stocks became severely overbought. Many of the technical indicators for the sector were stretched farther than they’ve been in years.

Heck, Mom even called me, saying she wanted to buy gold stocks. That’s the best sell signal I know.

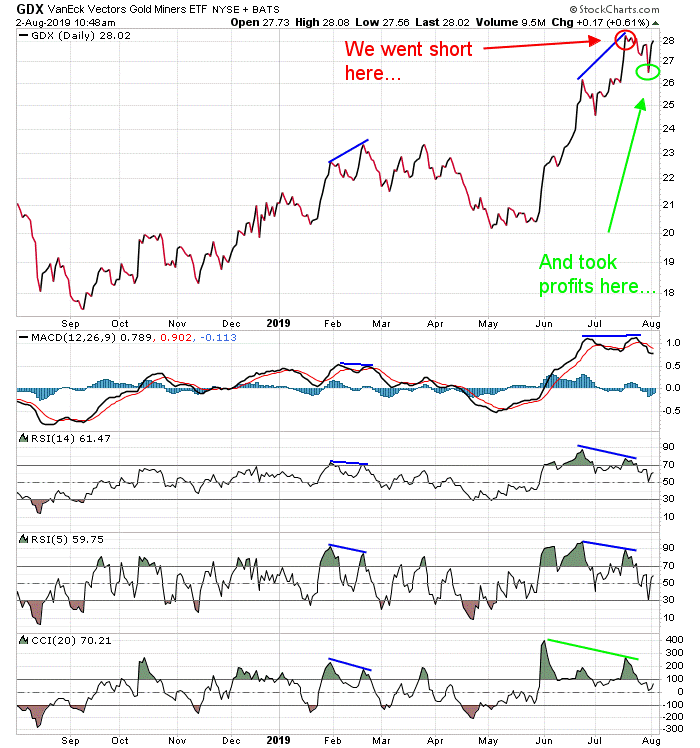

That set up a good chance to quickly profit on the short side. Here’s the chart I sent to subscribers the day I recommended a short trade on the VanEck Vectors Gold Miners ETF (GDX)…

And here’s what I told subscribers at the time…

GDX has rallied nearly 37% over the past six weeks. It’s overbought and well extended above its 50-day moving average (MA) (the squiggly blue line). The action over the past month has created negative divergence on all the various technical indicators at the bottom of the chart. This happens when a stock makes higher highs but the indicators make lower highs. It’s a sign that the momentum of the rally is fading. And, it’s often an early warning of a potential decline.

This is an ideal candidate for a short trade.

Clearly, it was just a matter of time before gold broke down. Let’s take a look at the same chart, just two weeks later…

As always in Jeff Clark Trader, we took profits when we doubled our money on the trade. So, we’re now riding the second half of our position risk-free.

Make no mistake, I think gold will be much, much higher in the months ahead. And when the stock bull market ends, we might even see gold make new all-time highs.

But as traders, we’re always looking for opportunities to make money on big, short-term market swings – even when it goes against our longer-term beliefs.

The gold stocks gave us our most recent opportunity. They’ll probably give us several more opportunities in the months ahead.

Best regards and good trading,

Jeff Clark

P.S. GDX is one of the three – yes, just three – stocks we trade each month in Jeff Clark Trader. And there’s a reason why I limit it this way…

One of the biggest things that intimidates new option traders is just how many stocks there are to trade in the markets. It can be overwhelming.

But, it really isn’t about the stocks themselves. It’s about the strategy. And, I handpicked these three stocks to be the best, most profitable ways for new option traders to learn and make money using my strategy.

If you want to take more direct control over your portfolio’s potential… and not rely on a decade-old bull market for your retirement… You should click here and see what Jeff Clark Trader is all about. It’s only $19 for a whole year. But act quickly – that price won’t last long…