Gold stocks are ready to run, again.

The great gold stock rally of 2021 started about one month ago.

The VanEck Vectors Gold Miners Fund (GDX) was trading at $32 near the end of March. It rallied up to $36.80 by the middle of April. That’s a 15% gain in just two weeks.

It was a great start to what should be a BIG move higher.

But, the gold sector has been on hold for the past several sessions. GDX has been drifting lower. And, lots of folks are wondering, “Is that it? Is that all there is to the gold stocks rally?”

To those folks, all I can say is this…

The rally is just getting started. Gold stocks will be much higher in the weeks and months to come as the gold sector plays catch-up with the rest of the stock market.

The recent pullback in the sector is simply a chance to buy the gold stocks before the next leg higher.

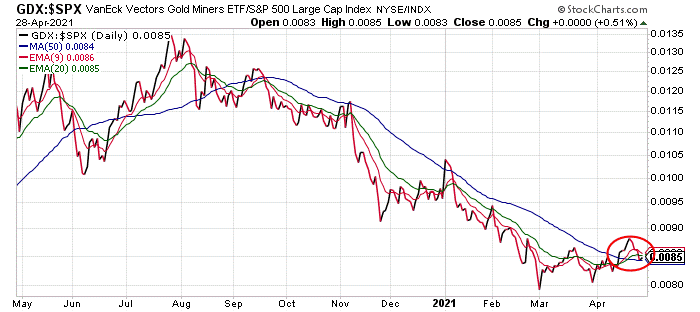

Look at this ratio chart of GDX divided by the S&P 500…

This chart compares the action in the gold sector to the action of the broad stock market. When the chart is falling, GDX is lagging behind the performance of the S&P 500. When the chart is rising, the gold sector is beating the broad stock market.

This chart is currently near its lowest level of the past year. That means the gold sector has been severely lagging behind the market. But, the chart has been rising over the past month. And, that rally has a long way to go.

The GDX/SPX ratio popped above all of its various moving averages (MA) earlier this month. And, those moving averages have just crossed into a bullish formation – with the 9-day exponential moving average (EMA) above the 20-day EMA, and the 20-day EMA above the 50-day MA. This often marks the

start of an intermediate-term rally phase.

|

Free Trading Resources Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |

You’ll notice this chart had been declining steadily since last August – when the ratio fell below its various moving averages lines – and those MAs crossed into a bearish formation. That decline phase lasted eight months.

A similar rally phase should last just about as long.

We’re only one month into the great gold stock rally of 2021.

There’s a long way left to go.

It won’t be a straight-shot higher for the gold sector, of course. But, the gold stocks should be much higher in the months to come.

Traders should use any pullbacks along the way as a chance to buy.

Best regards and good trading,

Jeff Clark

P.S. While gold stocks are gearing up for big moves, I’ve had several other low-priced stocks on my radar exploding more than 100% in the past year. And, I have a specific system that shows you exactly how to trade them.

It’s called the FLIP Trades System… And, it’s a way for traders to identify rare trade setups, and take of advantage them – before the rest of the market catches on. Already, my subscribers have seen gains of 131%, 148%, and 158% just by using it.

And just this Wednesday, I hosted a free presentation teaching folks how to start using my FLIP Trades System now in order to find these types of profit opportunities.

You can still watch a replay of my special presentation – and get three free trade setups – for just a little while longer. Click here to learn what makes this system so simple, yet so effective.

Reader Mailbag

Today in the mailbag, Jeff Clark Trader member Richard gives a word of thanks…

Jeff and friends, thank you for your candid strategy and truthful advice with no nonsense. After a great many years in searching for the right options educational team and partnering, I have finally found my financial family.

I’ve been out of work since May 2020… And I’m looking forward to better days ahead with a conservative, real-income earnings strategy that will not decapitate me, and allow for a bounce back to normal living again. Cheers.

– Richard

Thank you, as always, for your thoughtful comments. We look forward to reading them every day. Keep them coming – and send us any questions – at [email protected].