The Mother Indicator (MI) flashed a sell signal on one of my favorite assets last Thursday.

You’ll recall from Friday’s Market Minute essay, a Mother Indicator sell signal is generated whenever my mother calls me and wants to buy a particular investment. The MI has a near perfect track record as a contrary indicator – meaning… when mom wants in, we should all get out.

There are only two requirements for this indicator…

-

Mom has to call me

-

Mom has to bring up the idea

In other words, if I initiate the phone call or if I prompt mom with a question like, “Hey, what are you thinking about doing with your money these days?” then there is no signal.

Mom has to call me, and she has to bring up the subject.

My phone buzzed last Thursday at about noon. Mom wanted to buy gold stocks.

“Why would you want to buy gold stocks now?” I asked.

“Well,” mom replied, “the girls (which I’m pretty sure means her church choir) and I were talking about it last night. And, I remember you said something to your brother during Thanksgiving about liking gold. So, I thought maybe I should put some money there.”

That, my dear readers, is a Mother Indicator sell signal. And, if this signal is anywhere near as accurate as previous MI sell signals, then it’s time to sell the gold stocks.

Here’s another reason…

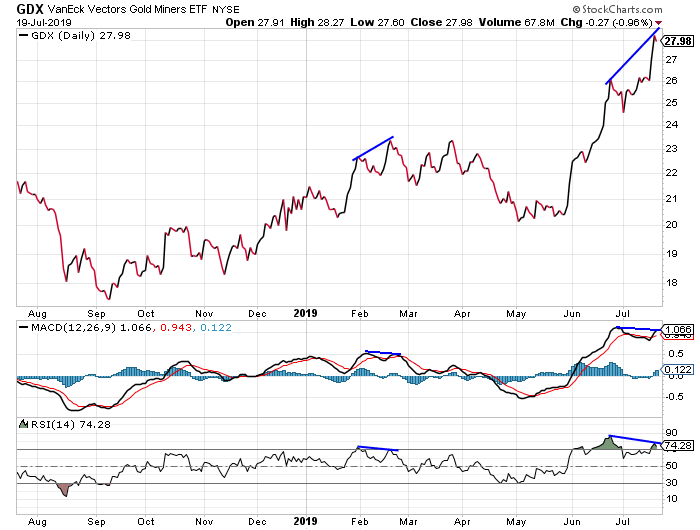

Look at this updated chart of the VanEck Vector Gold Miners Fund (GDX)…

GDX has rallied about 36% over the past two months. The sector is extended and overbought. And there is negative divergence on the MACD and RSI indicators – meaning that as GDX has made new highs, the indicators have made lower highs. This negative divergence indicates the momentum behind the rally is weakening. And, we may be nearing a turning point.

GDX had similar “negative divergence” – though from a much less overbought level – back in February. That condition led to an immediate 6% decline in GDX, followed by a nearly three-month long period of just chopping around.

The situation today, though, is a bit more extreme. The technical indicators are more overbought than they were back in February. And, the chart of GDX is much steeper. So, the gold sector may be in for a larger correction – soon.

So, I’ll offer you the same advice I gave to my mother on Thursday…

“Hang onto your money for now,” I said. “You’ll probably have a chance to buy gold stocks at lower prices in the weeks ahead.”

Best regards and good trading,

Jeff Clark

P.S. Before I let you go, I wanted to pass along something that came across my desk recently…

My colleague Jeff Brown is a Silicon Valley insider and he’s best known for his work in the technology sector. Now, I’m not a tech investor like him…. I’m a trader. But what Jeff recently sent me recently really caught my attention…

In short, it’s a trading strategy that’s unlike anything I’ve seen before, and I wanted to share it with you folks. After all, he does have a personal success rate of 95.3%. So, I put together a quick video for you explaining everything. Click here to watch now.

Reader Mailbag

Do you own gold? Do you think now is a good time to sell?

Let us know… along with any other trading questions, stories, or suggestions at [email protected].