There’s a curious thing going on in the bond market.

We all know interest rates have been going up. The yield on the 30-year Treasury bond started the year at 2.75%. Today it’s 3.05%. The yield on the 10-year T-note has risen from 2.4% last December to 2.94% today.

Logically, as interest rates go up, bond prices fall. That’s because new bond buyers want the higher rate, and the only way that happens on the old bonds is if the price gets discounted. So, the more interest rates go up, the more bond prices have to fall.

Except, apparently, in the high-yield bond market.

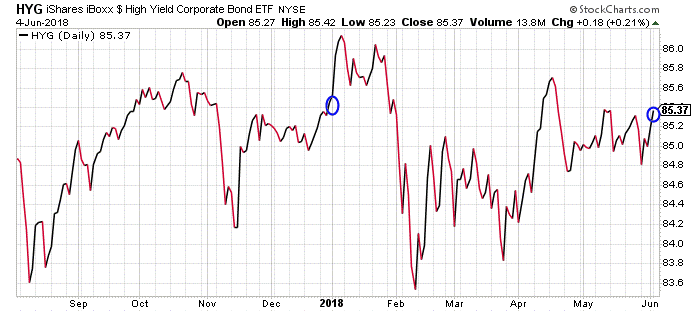

Junk bonds – which are considered “less than investment grade” – are trading for roughly the same prices at which they started the year. For example, look at this chart of the iShares iBoxx High Yield Corporate Bond Fund (HYG)…

HYG started 2018 at $85.40 per share. It closed at $85.37 yesterday.

So, as interest rates have climbed higher, and as Treasury Bond prices have fallen, investors have continued to buy high-yield bonds.

That seems odd to me.

It’s like walking into the grocery store and seeing that filet mignon is on sale for $6 per pound, but folks are buying beef liver instead at the regular price of $4 per pound. For just a little more money, shoppers could get a much better piece of meat.

For just a little more money in the bond market, investors could get a AAA-rated U.S. Government backed bond – on sale. But instead, they’re paying regular price to buy bonds rated BB and lower.

The only explanation for this is that investors still like risk. They’re not worried about the economy or about the chances of lower-rated companies to default. So, they’ll keep buying the junk bonds at a slightly higher yield rather than buying higher-quality bonds at sale prices.

And as long as investors are willing to do that… as long as they’re willing to take such risks in the bond market… then they’ll be willing to risk money in the stock market as well.

I’ve written plenty of times before about how the prices of high-yield bonds tend to lead the stock market by anywhere from two days to two weeks. And that’s why I’m not particularly concerned about the stock market just yet. As long as HYG is holding up, and investors continue to buy junk bonds, we don’t need to worry too much about the stock market.

That will change, of course. I suspect junk bonds are likely to start selling off sometime later this year. When that happens, stock traders will want to head for the exits.

But for now, investors still love risk. So, there’s nothing to worry about… yet.

Best regards and good trading,

Jeff Clark

Reader Mailbag

Today, a kind note from a Market Minute reader…

Thank you Jeff, keep up the good work and your wonderful insights.

– Michael

And the responses to last Friday’s Mailbag issue continue to pour in…

Great response on religion and humor! Keep it up!

– Robert

Jeff, don’t change. Continue to let your personality and sense of humor come through in your writing. You will never make everybody happy.

– John

God made a few perfect heads, and then He covered all the others with hair. I guess that means my head is almost perfect.

– Chuck

Just a word of support for your response to the writer who objected to your comment on repression. Well said, Jeff. I believe many will share your beliefs and can speak from experience. Please continue to be yourself and not get into the political correctness which is ravaging our society.

– Andrew

Thank you, as always, for your thoughtful insights. Keep them coming right here.