It has been a remarkable month for the gold sector. The VanEck Vectors Gold Miners Fund (GDX) is up 23% since the start of June.

Think about that for a moment. GDX is basically up an average of 1% per day for the month. If it keeps that up for a year… well… you can imagine the gains.

And, if you listen to a lot of the gold stock enthusiasts over the past weekend, you might think it could actually happen. But, not so fast.

Yes, it has been a beautiful run. And yes, the gold sector will probably be even higher by the end of the year than where it is today. But, for the very short term, the gold stocks can use a break.

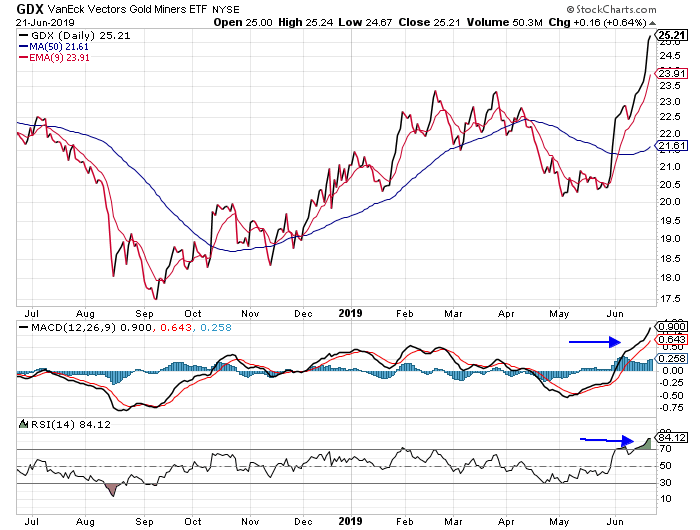

Take a look at this updated chart of GDX…

The nearly straight-up action over the past three weeks sure stands out. In the process, though, momentum indicators like the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) have reached extremely overbought levels. They’re more overbought now than at any time over the past year. In fact, you’d have to go back to February of 2017 to see a similar condition. That’s a caution sign. GDX fell about 15% in two weeks following that setup back then.

You’ll also notice that GDX is now trading about 16% above its 50-day moving average (MA) line (the squiggly blue line on the chart). GDX rarely strays more than 8% from its 50-day MA before reversing and coming back towards the line.

So, the gold sector needs to take a break here. GDX is overdue for a pullback, or at least a period of consolidation that will work off the overbought conditions and give the moving averages time to catch up to the current price of the stock.

A little choppy, back-and-forth action over the next few weeks will help GDX build up the energy to fuel another move higher – perhaps later this summer.

For now, though, traders should hold off for a bit before adding exposure to the gold sector. Trimming some profits here is not a bad idea. We should have a better opportunity to put money to work in the gold stocks a few weeks from now.

Best regards and good trading,

Jeff Clark

Reader Mailbag

Today, readers catch up on Jeff’s Father’s Day essay…

What a wonderful story! Thanks for sharing your beautiful memories of your dad with us. You’re also a good storyteller, too. Happy Father’s Day to you!

– Sukhee

Jeff, I almost skipped over this Market Minute, as I have been out of town visiting my son and have some catching up to do with emails. Boy am I glad I didn’t. Cheers to you, your father, and sons. What a great tribute. I, too, love that left field fence.

– Ron

And a Delta Report subscriber thanks Jeff for the service…

Thank you for all your recommendations. I have never traded options before and it took a while to get my brokerage approval for options trading. Today, I finally was able to place my first order. Thank you.

– Natalia

Thank you, as always, for your thoughtful insights. We look forward to reading them every day. Keep them coming at [email protected].