Volatility is dead. At least, that seems to be what most speculators are thinking these days.

In the futures market, speculators have ramped up their Volatility Index (VIX) net short position to 178,000 contracts. That’s the largest net short position – ever.

What could possibly go wrong?

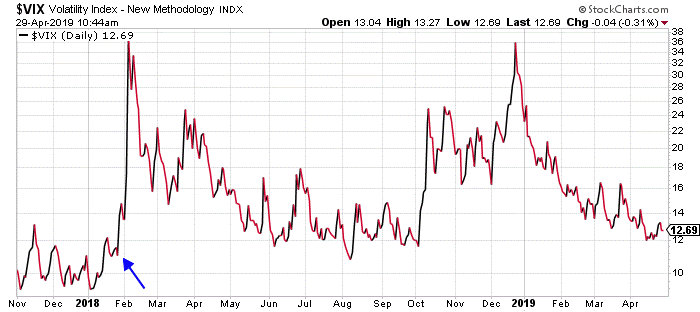

Take a look at the following chart of the Volatility Index. Pay special attention to what happened in late January 2018 – the last time speculators were net short more than 160,000 contracts…

In early February 2018, the Volatility Index tripled in less than two weeks.

That’s the thing about volatility. Periods of low volatility are ALWAYS followed by periods of high volatility, and vice versa.

And, those “high volatility” periods often happen when speculators are all loaded up with short VIX futures contracts.

Of course, it doesn’t have to happen this way. Heck, I’ve been looking for a spike in volatility for the past few weeks and it remains elusive.

But, at this point, knowing the tendency for volatility to show up as if out of nowhere, knowing the market’s habit of punishing the popular trades, and knowing the potential for big stock market moves to occur around Federal Open Market Committee (FOMC) announcements and monthly jobs reports, traders should consider this question…

Is this really the time to be shorting volatility?

It seems to me there are plenty of better, lower-risk trades available in the market than shorting the Volatility Index while it’s trading near its lowest level of the year.

Best regards and good trading,

Jeff Clark

P.S. Just one last thing before you get your day started…

My team and I have been working on a new project… and it’s huge. It’s something I hope will encourage more of you to become option traders. In the turbulent market environment I see coming, there’s simply no better way to make money. And “simple” is the key word there…

In short, I’ve devised a way for anyone to get started trading options. It’s so simple, and profitable, I firmly believe it can help you land an early, comfortable retirement.

I can’t give you all the details just yet. But I will soon.

Just keep an eye on your inbox next week. That’s when I’ll make the announcement.

Reader Mailbag

How have you been trading while volatility has been “dead”? Which trades have you had the most success with?

Let us know what you think about volatility in the market, along with any other trading stories, questions, or suggestions, at [email protected].