Now is not the time to be buying oil stocks.

In fact, if history is any sort of a guide, aggressive traders might look to short the energy sector in anticipation of a quick pullback.

Let me explain…

The Energy Select Sector Fund (XLE) is up 100% since its October low. Energy stocks have gone from one of the worst performing sectors of the market in 2020, to one of the top sectors in 2021. By just about any measure – the sector is overbought.

And, it’s operating under a “sell” signal from the Bullish Percent Index (BPI).

A BPI measures the percentage of stocks in a sector that are trading with bullish technical patterns. It’s designed to measure overbought and oversold conditions.

|

Free Trading Resources Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |

An index is generally overbought when it registers above 80 – meaning 80% of the stocks in the sector are trading with bullish patterns. An index is oversold when it drops below 30.

Here’s how the Energy Sector Bullish Percent Index (BPENER) looked on Friday…

The red arrows on the chart point to times when BPENER rallied above 80 and then turned lower from overbought conditions. That action generates a BPENER sell signal. It’s usually a good idea to avoid buying energy stocks in this situation.

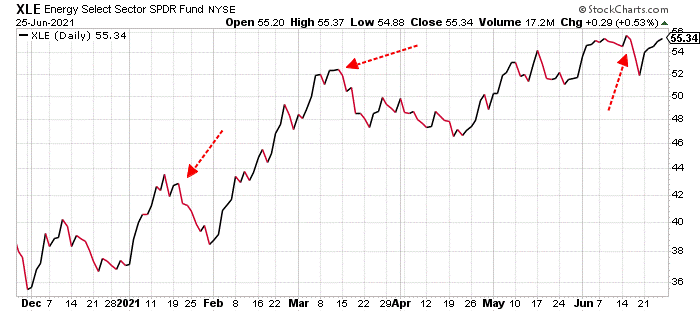

Here’s how those arrows coincide with the action in Energy Select Sector Fund (XLE)…

Following the BPENER sell signal in January – XLE fell about 10% in two weeks.

XLE suffered a similar decline over the span of one month following the March sell signal. A similar decline from the current overbought situation would have XLE trading near $50 per share over the next two weeks.

Of course, there’s no way to know for sure how this current sell signal will play out.

It’s a pretty good bet, though, that the immediate upside is limited. So, there’s no real urgency to jump into the energy sector right now.

Traders should give the recent BPENER sell signal some time to play out before buying into oil stocks. We’ll likely have a chance to put money to work in the sector at somewhat lower prices in the weeks ahead.

Best regards and good trading,

Jeff Clark

Reader Mailbag

In today’s mailbag, Jeff Clark Trader member Paul thanks Jeff for bringing him back to reality…

Jeff, you’ve made me a believer. I listen to CNBC all week while following the market and was ready to start selling today until I read your article. I stopped selling and started analyzing. I’m committed to look at daily price charts before selling – not commentators. Thanks for bringing me back to reality.

– Paul

And here, Jeff Clark Trader and Delta Report member Sudhir thanks Jeff for a recent trade recommendation…

Hi Jeff, thank you so much for the trade we made over the last couple of months. So, when you asked us to sell the June 18 expiry options, I sold them, but I at the same time I bought some new options for the July 16 expiry.

The last few days have been fantastic for these new call options. A very big thank you for pointing us towards a great company stock.

– Sudhir

Thank you, as always, for your thoughtful comments. We look forward to reading them every day. Keep them coming – and send us any questions – at [email protected].