The Volatility Index (VIX) triggered a new buy signal yesterday when it closed back inside its Bollinger Bands.

In the process of generating that buy signal, the S&P 500 gained 37 points. That’s just a small portion of the 190 points the index lost since the start of August. So, there’s more upside ahead and the bounce should last a few days.

But, as I mentioned on Monday, I’m only looking for a quick, three- or four-day bounce – not an intermediate-term rally phase that lasts for several weeks. If you bought stocks on Monday with me, you should be looking to take profits on those positions near the end of this week – especially if the S&P rallies up to an obvious resistance level.

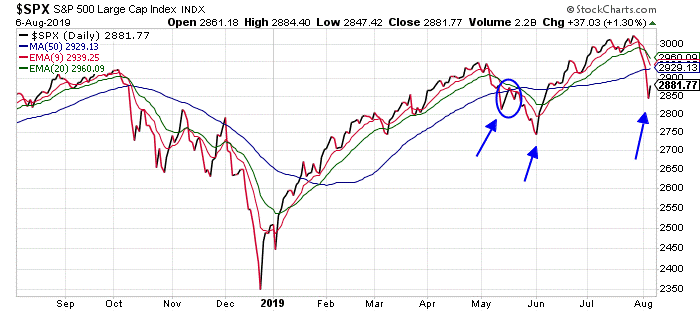

Let’s look at the daily chart of the S&P 500…

The current action in the S&P 500 looks a lot like the action we got during the first VIX buy signal in May. Back then, the index had dropped below its 50-day moving average (MA) line (the squiggly blue line on the chart). Conditions stretched into oversold territory. And, the VIX buy signal told traders to expect a quick, snap-back rally.

That rally was good for about 80 S&P points. The index rallied back up to its 50-day MA. It worked off the oversold conditions. Then we got a more significant move lower – which led to a more significant VIX buy signal at the end of May.

Like I said… the current action looks quite similar to the first VIX buy signal in May. The S&P 500 is oversold enough to fuel a rally back up to its 50-day moving average line – near 2930. But, that may be all we get from this bounce.

Traders should keep an eye on technical indicators like the McClellan Oscillators (NYMO and NAMO) for signs of overbought conditions. If the NYMO and NAMO rally up towards their upper Bollinger Bands and the S&P 500 bumps into the resistance of its 50-day moving average line, then that will be a good time to take profits on anything purchased earlier this week.

For now… we’re working off of a new VIX buy signal. There’s more upside ahead – at least for a few days. We’ll look at things again on Friday and see where we stand at that point.

Best regards and good trading,

Jeff Clark

Reader Mailbag

Did you buy stocks on Monday? How are you planning to trade the rest of the week?

Let us know, along with any other trading questions, suggestions, or stories at [email protected].