The stock market closed at another all-time high on Friday. The momentum is still bullish, with the S&P trading above its 9-day exponential moving average (EMA). Semiconductor stocks (SMH) and high-yield bonds (HYG) are looking a little tired. But they’re still pressing higher. Until these two leading sectors start to weaken, there’s no reason to bet aggressively against the market.

There are some caution signs, of course. But, the market is ignoring the warnings for the time being. So, for now, the bulls have the momentum. There’s really nothing else to say.

Over in the gold market, though, there’s something more interesting happening…

Gold and Gold Stocks

Gold popped $12 higher last week. But the VanEck Vectors Gold Miners Fund (GDX) – a fund of large-capitalization gold stocks – ended the week lower by 0.8%.

At first glance, this is a bad sign for the gold sector. Gold stocks tend to lead the metal. And the sector always does better when gold stocks are rallying stronger than gold itself.

So, last week’s underperformance in gold stocks could be a “caution” sign for an impending decline in the price of gold.

Or… it may not be that simple.

Let me explain…

One of two things happen when gold stocks underperform the metal. Either the price of gold falls in order to catch up to the decline in gold stocks. Or gold stocks rally in order to catch up with the price of gold. The outcome usually depends on the look of the GDX/Gold ratio.

If gold stock underperformance occurs when the GDX/Gold ratio is high, then look for the price of gold to fall. On the other hand, if the GDX/Gold ratio is low while gold stocks are lagging the metal, then odds favor the stocks rallying to catch up with the metal.

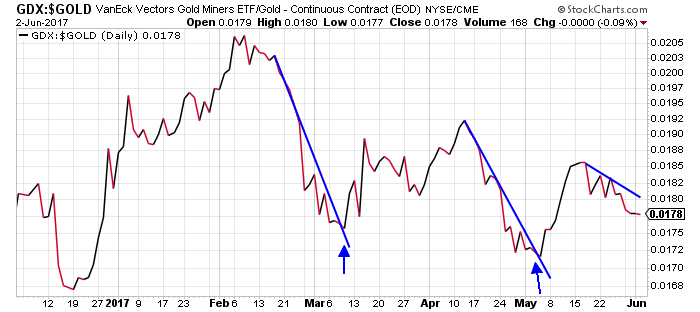

Look at this chart of GDX divided by the price of gold…

For the past six months, this ratio has traded between 0.0168 and 0.0205. On Friday, the ratio closed at 0.0178 – near the bottom of the recent trading range. Gold stocks are already trading relatively low compared to the metal.

So while the chart displays weakness in gold stocks – which is usually a bad sign for the metal – the ratio is low enough that much of any potential damage is already priced into the sector.

The blue lines are downtrending resistance lines. The chart needs to break above those lines in order to signal a new rally phase in gold stocks. Look at how GDX performed when the ratio broke above the resistance lines in March and in early May…

Yes… gold stocks are currently underperforming the metal. That’s usually a caution sign for gold. But, the underperformance is happening while the GDX/Gold ratio is already near the bottom of its recent trading range. So, gold stocks have likely already discounted the potential for a pullback in the price of gold.

If the ratio turns higher from here, and if it can break above the current downtrending resistance line, then gold stocks will likely enter a new short-term rally phase.

I’m not willing to bet aggressively on gold stocks until the GDX/Gold ratio breaks above resistance. But I continue to like the idea of slowly adding exposure to the gold sector on weakness. Last week’s action gave us a good chance to do just that.

I’ll update Delta Report readers on these trends throughout the day on Jeff Clark Direct.

Best regards and good trading,

Jeff Clark

Mailbag

Thanks to all my readers that sent in feedback this past week. A lot of folks are asking for more details on the algorithm I developed to trade around earnings… Stay tuned. I’ll be releasing more information this Wednesday.

In the meantime, if you’ve got any questions, comments, or great trading stories, don’t hesitate to send them right here.

Jeff, I’m a big believer in your earnings algorithm. I’m all ears considering I’ve done well since trading your recommendations. Thanks!

– Marc D.

Jeff, you really opened your heart in Friday morning’s feedback reply. I love knowing about this “keeping your edge” thing you describe. Thank you. I love the way you explain things, Jeff. Like your comment on why to look at the 15-min chart. Most others would just refer to it with no explanation.

One of the many things I appreciate about you. You take care of us without condescending.

– Barbara D.

I have been an Investor for 50 Years and have used many paid for newsletters and services during this time. I have been your subscriber since February. I have found your information to be exceptional with your insight, analysis, and use of MACD, RSI, and Bolinger Bands on charts. The last several weeks your information of the Markets reaching a possible top has been clear. With this information and charts of VIX, I purchased VIX June 11,11.5 calls on May 9th with VIX In the 10 range. I closed these on the morning of May 18 with about a 50% gain.What better information could a subscriber ask for or expect to make a trade? THANK YOU Mr Clark for the outstanding information, charts, and analysis you provide.

– Jack G.

Jeff, I’m following your Delta Report, but have not jumped in with both feet yet. I’d like to learn more about your algorithm and how it works. Thanks for your insights.

– David G.

Jeff, I was able to make a nice quick profit on Urban outfitters in 24 hours. I was unable to get into the Guess trade or I would have opened a position. I’m curious about what the new platform would be. Thanks.

– Toby K.

Thanks, Jeff for the GES earnings recommendation! I was able to book 95% profit on the one day recommendation. Would love to hear more on how your earnings algorithm strategy works.

– Steve L.

Jeff – I loosely followed you when you were at Stansberry cherry-picking trade opportunities that I felt comfortable with or knew enough about the underlying security. Unfortunately, I recently passed on the GES trade because of the associated risk of retailers in general. I had sold May $30 calls just days before the Macy’s earnings report expecting bad news and got it. So, was not too sure about getting into the GES trade thinking another retailer could get hit hard (particularly apparel) – guilty by association? In hindsight, I wish I had trusted your insights more and done it. However, I want you to know that I took trades in GDX, DGX, TGT, TWTR, TLT, QCOM and AG with great results. I adjusted the TEVA trade a bit from your recommendation and turned the initial loss into a small gain on the 2nd trade. Very pleased with the results so far and look forward to the future.

– David W.

Missed the Toll Bros. trade, but made 80% on my URBN and GES trades. Also, don’t recall exact details from Jeff on QCOM, but made 80% on that trade as well. Also, have had losses, but that happens! Love this new algo Jeff!!

– David F.

Hi Jeff. First I’d like to say that I’ve followed your advice for many years now. I’ve lost and I’ve gained. I’ve subscribed, asked for a refund, subscribed again, made some money and I’ve gotten frustrated. (I was younger and awfully uneducated on the options markets and apologize for any rash judgments). I’ve certainly come to realize you have to take responsibility for your own trades yourself. Jeff Clark is not forcing me to buy 20 more options then I should. Asset allocation is a huge portion of the game. I’m the one that needs to provide the restraint and proper trading plan.

After additional years of trading with you, I realized I was not successful mostly because I was the one “Forcing or Jumping” a trade when only an idea was discussed versus an actual trading plan. Or improper position sizing trying to make up for previous trading flaws. Some of the most successful trades I’ve made with you have been the ones where I’ve missed out and a few weeks later you would come back and say something like, this is an even better set up with minimal downside then before.

I want to say I have certainly learned a lot from your services and experience. I appreciate all of your hard work and thick skin for being able to deal with irrational traders and subscribers. I certainly love to hear when you are confident with a trade or a direction of a market. It gives me piece of mind knowing we are going in the right direction. Thanks again for all that you have done.

– Joe V.