After an amazing year in 2022, the dollar’s fortunes have changed course once again.

Heading into September, the Dollar Index (DXY) was up over 20%. But at the end of the month, the dollar started to give back some of those gains.

Over the next few months, DXY declined by around 12%. For the reserve currency of the world, that’s a very unusual move.

The dollar is supposed to be stable. It helps keep international trade (and the global economy) going.

And as long as interest rates remain elevated I don’t see this currency volatility going anywhere.

Right now, I think the buck has started its next big move…

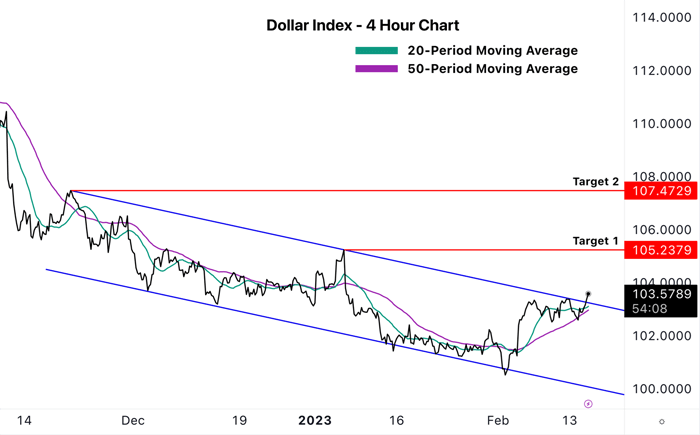

To show you what I mean, take a look at this chart of DXY…

Two important things going on with this chart…

First, we have a “bullish cross” involving the 20- and 50-period moving averages (MA – green and purple lines). These two MAs are highly reliable at identifying intermediate-term trends.

Since November, these two MAs have been mostly in a bearish cross, leading price lower.

But on February 6, they crossed upwards, and we’ve seen a strong rally as a result.

So long as these two averages don’t cross back down, we can expect to see a continued upside in DXY.

The second important feature is the trend channel (blue lines) that has contained the decline in DXY since November 2022.

|

Free Trading Resources Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |

Last week, the dollar was able to break out of the channel. This breakout, combined with the bullish moving average cross, means that (at least for the near future), the dollar should find some strength.

I’m not positive whether this strength signifies a true shift in trend… or if it’s going to turn out to be a brief rally in what is a larger bear market.

That’s why I’ve identified a series of near-term targets in DXY.

Take another look at the chart…

Target one is the high from January 6 at 105.24.

Target two is the high from November 21, which is also the top of the channel. This level comes in at 107.47.

My analysis tells me that the potential for DXY to reach these targets is quite high.

So, from a trading standpoint, my strategy will be to look to buy the dollar on dips until further notice.

Ultimately, I expect this move in the dollar to be the strongest rally we’ve seen since September 2022.

Happy trading,

Imre Gams

Analyst, Market Minute

Reader Mailbag

In today’s mailbag, a Currency Trader member expresses his appreciation for Imre’s forex service…

Hi Imre,

I just signed up for your new service and have opened a paper trading account with Oanda. I took your last trade and was stopped out. However, I’m really excited to sign up as I like your approach to the trade and your post-mortem analysis video was just brilliant.

No one else does this, and I learned a lot. Please keep telling us about the reasons for the trade, the entry, stop loss. and profit points. As well as the debrief on the trade, whether successful or not since we can learn so much from your talented approach. Thanks again.

– Vince T.

Thank you, as always, for your thoughtful comments. We look forward to reading them every day. Keep them coming at [email protected].