In Market Minute, our beat is the financial markets… what to look for… how to analyze it… and how to trade it.

Often, as part of the analysis, we have to look away from the markets and consider the broader picture. Specifically, events (large and small) that provide context to the market’s actions.

For that reason, it’s impossible to ignore what’s going on in the Middle East right now. No one can deny that it has impacted the markets. Of course, conflict in the Middle East is nothing new…

The State of Israel has been around since May 14, 1948. That same day, fighting broke out during the 1948 Arab-Israeli War.

Since then, Israel has been involved in 16 large-scale conflicts with its neighboring Arab nations. The most recent before this one was in 2021, which lasted 12 days before a ceasefire.

The latest war broke out on October 7. Hamas, the terrorist organization in control of the Gaza Strip, launched a surprise attack against Israel. The attack resulted in the deaths of 1,400 Israelis. This marked the greatest massacre of Jews since the Holocaust.

Israel responded by devastating the Gaza Strip. Thousands more have died.

The big question right now isn’t just about how this war is going to end. It’s also about whether other countries will get involved.

If this war does escalate, the consequences could be devastating. You see, it’s all to do with oil. And that brings us back to the markets.

I recently wrote about what this war means for oil in the short-term. I’m still calling for a move lower. Oil could end up briefly trading in the high $70 per barrel range.

But what happens after that initial sell-off? According to my analysis, it’s more likely that oil is going to rebound to much higher prices…

So let’s get into the analysis behind oil prices right now.

My method for forecasting the price of a market relies almost entirely on technical analysis. But technical analysis can’t explain why prices will make those moves.

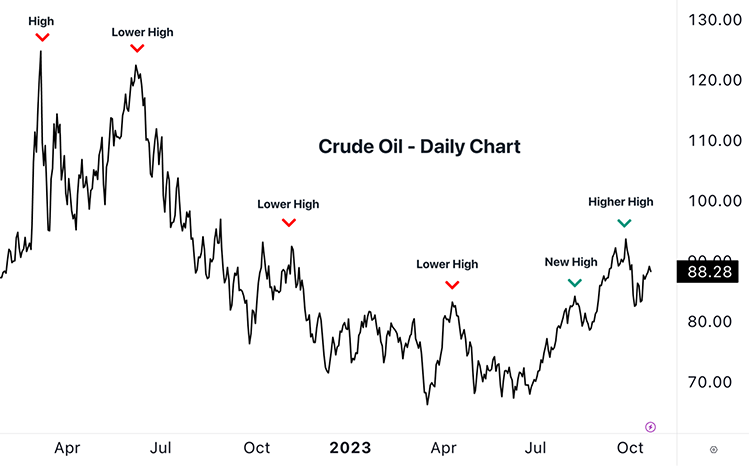

Let’s start by looking over a chart of crude oil…

Notice that between March 2022 and April 2023, the market put in a series of consecutive lower highs. From a technical perspective, that’s a clear indication a market is in a downtrend.

But in August 2023, crude oil made a new high. That’s an initial warning sign that the downtrend is losing strength. And toward the end of September, the market confirmed those suspicions by making a higher high.

This change in character, as indicated by the price chart, tells me we are likely due for higher oil prices in the long-term.

That’s the “what” that technical analysis is great at answering. The why has become a lot clearer over the last several days…

An escalation in this current war would be the most logical explanation for why crude oil prices could suddenly shoot higher.

That’s where fundamental and macroeconomic analysis come into play.

There’s no real shortage of oil in terms of its available supply. Oil prices could surge if there are roadblocks in getting that supply directly to the market.

As a further deterrent to Iran getting directly involved in this war, the U.S. could impose tougher sanctions on Iran’s oil exports.

The Strait of Hormuz is one of the world’s crucial waterways – it’s a major artery for the global energy trade. About 20% of all oil consumed globally is transported through the Strait of Hormuz. And it just so happens to be in Iranian waters.

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.

A significant escalation in this conflict could see Iran threaten the security of energy shipments in this area. That’s one potential catalyst as to why oil could break back above $100 barrel.

Right now, emotions are running hot on both sides of this conflict. It won’t take much for events to take a darker turn. And while the exact nature of those events can be unpredictable, it’s important for investors to be as proactive as possible.

So, while I still expect oil prices to come down soon, I’m gearing up for much higher energy prices in the future.

Happy trading,

Imre Gams

READER MAILBAG

Are you keeping an eye on crude oil?

Let us know your thoughts – and any questions you have – at [email protected].