These days, a 2% pullback from an all-time high feels like a market crash, with some already calling this another opportunity to “buy the dip.”

But, I’m not so sure…

It’s one thing if the market is expressing their bullish views by buying and owning shares of companies.

It’s another when they simply buy call options, hoping momentum continues in their favor.

This option buying spree has been behind the recent parabolic price action, not actual stock ownership…

What Tesla Means for the Options Market…

You see, the options market itself has become somewhat of a bubble…

One sign of a bubble is when it starts to pervade society, and this is exactly what’s happening right now.

Novice traders, with little-to-no experience other than YouTube videos (put together by other novice traders), have noticed that you can make crypto-like returns through the options market, which is true.

For instance, Delta Report subscribers were able to more than triple their money on Wheaton Precious Metals (WPM) for a 220% gain.

That’s because we rely on both economic and fundamental principles to make trading decisions.

And more importantly, we don’t just concentrate on the direction of the underlying stock – that’s only half the battle…

We slice and dice the option premium into the sum of its parts to see its true value. And that’s why fundamentally driven options strategies can generate crypto-like returns even when the market gets slow.

So, when Elon Musk put out a Twitter poll asking whether he should sell 10% of his stake in Tesla (TSLA) – which topped out at $1,200 a share and promised to abide by the results – it was stunning to see how the options market was still pricing in gains of 50% or more by the November 17 expiration date.

Regular Market Minute readers got that warning loud and clear in our October 29 essay where we gave you a glimpse into how we assess value in call options, using TSLA as example (before the poll came out).

Twitter voted to sell… and he did.

So now every single one of those call options we highlighted are set to expire and will be worthless.

Which brings me back to the original point…

Right now, option volumes are driving this market higher, not new stock ownership.

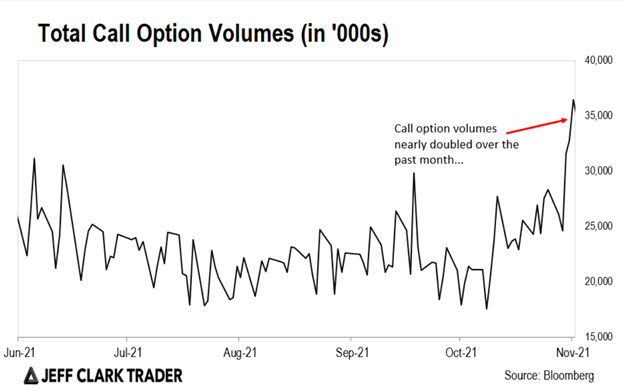

It’s not just TSLA though, call options across the market are being snatched up by frenzied investors.

Take a look at this chart…

The recent spike is substantial, and the fast and furious selloff in TSLA from its peak may be what’s in store for broader parts of the market.

You see, owning a call option gives you the right to buy the stock at a predetermined date and price… you don’t own the shares until the option is exercised (assuming it doesn’t expire worthless).

But here’s what most people don’t know…

|

Free Trading Resources Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |

When someone buys a call option, that means the market maker usually has to sell it to them.

Market makers are designated by the exchanges to provide liquidity and an orderly flow to markets. So, when someone buys a call option, they take the opposite side of that trade.

But their job isn’t to take directional risk, so they hedge themselves by buying shares of the underlying stock (each option contract represents the right to buy 100 shares).

So, at option expiry they close out their hedge and sell their shares.

That’s one reason behind the few times we’ve seen volatility this year during option expiration.

So, this brings us back to the recent pullback…

A 2% pullback from the highs might not seem significant, but it may be the start of a bigger pullback. That’s because, according to that chart above, TSLA isn’t the only one.

With all those calls set to expire on November 17, right before the Thanksgiving break, we can expect the market to take another dip.

Technically, the S&P 500 has been bouncing off its short-term eight-day moving average (MA) pretty consistently – until this Wednesday. That level is now acting as the resistance.

For instance, the market tried to break above this area (about 4670 on the S&P 500) and was rejected to close at 4649 on Thursday…

If it can’t reclaim that eight-day MA line soon, then this dip will have another dip… all the way down to at least 4500, the 50-day MA, or about 3% lower from current levels.

The last time the market traded that low was right around the time the options market went parabolic.

I don’t think that’s just a coincidence…

So, investors shouldn’t be looking for more gains from the stock market here. Instead, consider taking profits as this market continues to look frothy around expiration.

Regards,

Eric Shamilov

Analyst, Market Minute

Reader Mailbag

In today’s mailbag, Jeff Clark Trader member Peter comments on Wednesday’s Market Minute…

Gold broke through the neckline today! So I think gold is going higher! Thanks for your chart.

– Peter

Thank you, as always, for your thoughtful comments. We look forward to reading them every day. Keep them coming at [email protected].