The financial sector leads the broad stock market. When financial stocks are set up to act well, the stock market tends to follow. And when financial stocks look weak, it’s usually a pretty good warning sign the stock market is headed for a rough patch.

Back in early July, for example, we looked at a potentially bullish setup in the Financial Select Sector SPDR Fund (XLF) as a reason to be bullish on the stock market.

Today, though, XLF is sending a different signal.

Take a look…

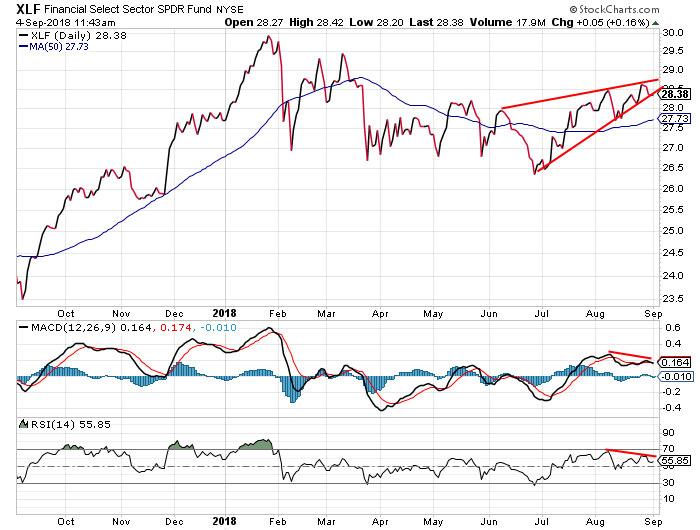

The chart of XLF is morphing into a bearish rising wedge pattern. This pattern often breaks to the downside in a sudden move that takes out at least half the size of the wedge.

That would give us a downside target of about $27.50 on XLF – or a drop of more than 3% from Friday’s closing price.

Notice also how the key momentum indicators, like the MACD and RSI, failed to make higher highs on the financial sector rally in August. This “negative divergence” is often an early warning sign of a potential change in the short-term trend.

If XLF breaks this wedge to the downside, then financial stocks are headed lower. And if financial stocks sell off, then the broad stock market will get hit with selling pressure as well.

Of course, a 3% decline isn’t a disaster. Heck, all that will do is take back the market’s August gains. So, I’m not suggesting that traders liquidate their portfolios and take on aggressive short positions.

I am suggesting, though, that folks who are looking to put money to work in the stock market are likely to have a better chance to do that a few weeks from now than today.

The financial sector looks weak. And that’s just another reason – in a long string of recent reasons – to be a little more cautious on the stock market right now.

Best regards and good trading,

Jeff Clark

Reader Mailbag

With the current bull run recently becoming the largest in stock market history, are you finding reasons to be cautious? Or not?

Let us know – along with any trading questions or suggestions for the Market Minute – right here.