Treasury bond prices have collapsed.

As a result, long-term interest rates have increased. The yield on the 30-year Treasury bond has jumped from 1.5% a few weeks ago to 1.95% today.

And, Wall Street is saying, “Whew.”

Remember, it was only a few months ago when everyone on Wall Street was worried about the inverted yield curve. Long-term interest rates had dipped below short-term interest rates. And, just about every time that has happened before, the economy slipped into a recession several months later.

That’s usually a bad sign for stock prices.

Now though, thanks to the Fed lowering its short-term interest rate targets, and thanks to the recent selloff in long-term Treasury bonds, long-term interest rates are higher than short term rates.

The yield curve is no longer inverted. The world is normal again. Folks aren’t so worried about a recession anymore. And, it seems like just about everyone is back to being bullish on the stock market.

But, not so fast.

Long-term Treasury bonds are supposed to be reliable, steady investments. They’re for our “safe” money. That’s where widows, orphans, and pension funds put money they can’t afford to risk.

Well… that so-called “safe” money is down almost 5% so far this month. Long-term Treasury bond prices are down almost 8% since early October.

It seems to me that when the value of reliable, safe assets falls so much so fast, maybe we shouldn’t be so complacent.

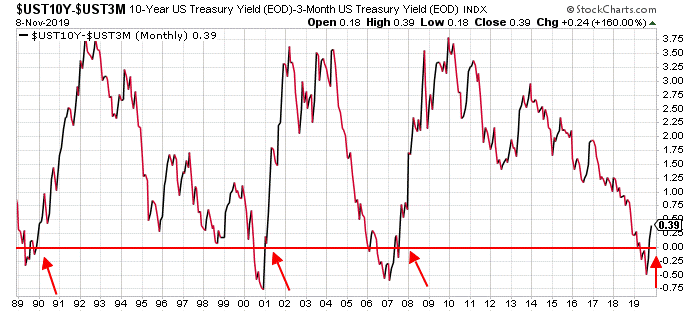

Take a look at this chart which shows the difference in yield between the 10-year Treasury note and the 3-month Treasury bill…

This is the chart that so many folks were freaking out about a few months ago when long-term interest rates dipped below short-term rates, and the yield curve inverted.

Now that the chart has reversed, and long-term rates are once again higher than short-term rates, most folks are breathing a sigh of relief. They’re not worried about a recession anymore.

But, this chart suggests that NOW is the time to be concerned.

You see… it’s not the inversion of the yield curve that signals a recession. It’s the sharp recovery from that inversion.

During my adult lifetime, the U.S. economy has suffered three significant downturns: one in 1990/1991, one in 2001, and one in 2008.

The S&P 500 fell 18% from its high to its low in 1990. It fell more than 40% during the recession that started in early 2001. And, it was cut in half during the financial crisis of 2008.

Prior to each of those downturns, the above chart dipped into negative territory and then suddenly reversed. Those reversals happened at right about the same time as the stock market peaked.

The S&P 500 rallied to another new all-time high on Friday. And, the yield curve is sloping higher again. Based on the look of the above chart, maybe we shouldn’t be saying “whew” right now.

An entirely different phrase comes to mind.

Best regards and good trading,

Jeff Clark

P.S. I have been fortunate in my life to have known many men and women who have served in the U.S. military. They are, without exception, some of the most hard-working, disciplined, honest, ethical, strong, and amazing people I know. Every day I feel blessed to be able to count them as friends.

So, Veterans Day is a big deal in the Clark household.

Thank you, veterans, for serving our country. Thank you for putting your lives at risk so that all the rest of us can pursue the potential that our amazing country offers. Thank you for defending the God-given right of my sons to pursue their goals.

The United States of America is an amazing country largely because of your service. So, thank you.

Thank you, thank you, thank you, thank you, thank you for your service.

Saying “Happy Veterans Day” just doesn’t seem like enough to recognize your service. But, then again, you’d never ask for anything more.

HAPPY VETERANS DAY!

Reader Mailbag

The mailbag’s been oddly light this past week… But we want to hear from you…

Do you think we’re due for a recession, as Jeff suggests? How are you preparing your portfolio?

As always, send in your thoughts – along with any questions, comments, or suggestions – to [email protected].