My 15-year-old daughter has been selling her digital art online.

Her initial goal was to make enough money to buy a Mother’s Day gift.

Fortunately, she quickly found out that her work was in high demand. After raising her asking price, she’s already exceeded her original goal. Now, she’s investing that money into supporting other artists.

Just a year ago she struggled to sell her work. So, after demand skyrocketed in February and March, she was puzzled…

But I’m not – it’s no coincidence that her income grew as millions of people received their stimulus checks.

Here’s another example, I went to the post office Wednesday. While I was waiting in line, I chatted with the young man standing behind me.

He told me he started an online store selling streetwear during the pandemic. He also reported seeing a lot more demand around the time people received stimulus checks.

All of this boils down to one simple reason – many people are now flush with cash.

This cash is having an impact on large companies too…

eBay reported earnings on Wednesday evening. The headline figure was positive, but the message was clear – they expect the profit bump from stimulus checks to run out soon.

It’s only a matter of time before sales return to pre-pandemic levels. And, there’s no doubt it’s weighing down the share price of the stock.

To keep the economic party going, we need lots of new stimulus.

The Fed believes that will be true until well after the economy is fully open again.

President Biden’s multi-trillion-dollar spending plans offer a clear insight into where the new money is going.

Trillions for education. Trillions for infrastructure. He also plans to make tax credits permanent.

That’s a lot of money ready to flood into the economy.

For one, it’ll help boost the economy. It’ll also create a lot more demand for basic materials, providing jobs all over the country. And, it’s good news for budding entrepreneurs that started businesses online in the last year.

|

Free Trading Resources Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |

Shopify is the first stop for many of those people. It offers a simple service. You can set up an online store to sell your products in less than an hour. Over a weekend, it’s possible to populate your site with all your photos and products. Then, all you need to do is market it and begin selling.

It really is that simple. The company gets a slice of every sale made, as well as a monthly maintenance fee. It’s a one stop shop for the new entrepreneur.

Shopify presents a radical change to the modern business model. No one is lining up to lease vacant retail spaces anymore. The rents are still high and the online market is so much larger for just about every product segment. The pandemic brought that fact home to everyone.

The future of retail is online. The companies that want to survive need to have an ecommerce solution and make it their priority.

So, as an investor, what’s the best way to capitalize on this shift?

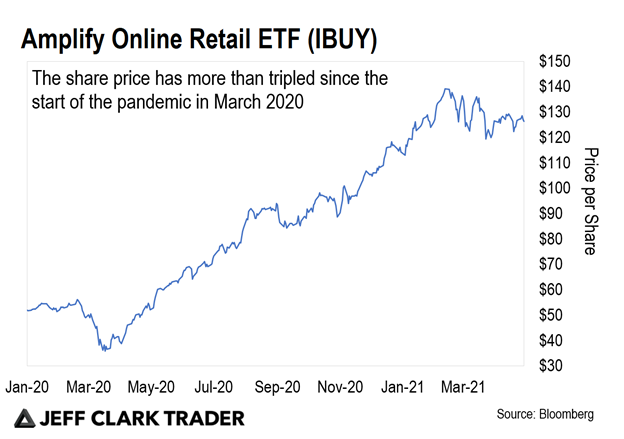

Well, the Amplify Online Retail ETF (IBUY) is an interesting way to pursue this theme.

The fund holds 58 of the largest and most significant online marketplaces. For example, these holdings include Groupon and Etsy, an online retailer for homemade goods.

Take a look at its performance over the last year…

Since bottoming at the start of the pandemic last March, IBUY has more than tripled in share price. This is largely due to skyrocketing demand for online shopping, as many were trapped in their homes and flush with cash.

IBUY peaked in February, and has been ranging with a mild downward bias since. That has unwound the short-term overbought conditions.

It’s now steadying. The likelihood that at least some of President Biden’s plans will become law could be the catalyst to see it break out to new highs.

All the best,

Eoin Treacy

Co-editor, Market Minute

P.S. With so much cash flooding into the economy under the Biden administration, many low-priced stocks have have seen their share prices double in short time. And, my colleague Jeff Clark has a simple, yet effective system to trade them that’s given his subscribers gains of 131%, 148%, and 158% – in just a few months.

Just this past Wednesday, Jeff hosted a free presentation teaching traders of all levels exactly how to identify these rare trade setups – and take of advantage them before they take off.

For just a little while longer, you can still click here to watch a replay of Jeff’s presentation – and get three free trade recommendations. But hurry, it won’t be up for long.

Reader Mailbag

Aside from retail, what other industries do you think are moving online? Are you betting on them?

Thank you, as always, for your thoughtful comments. We look forward to reading them every day. Keep them coming – and send us any questions – at [email protected].