The champagne corks were popping on Friday.

The Dow Jones Industrial Average closed above 28,000 for the first time ever. The S&P 500 conquered the 3100 level for the first time ever. Investors coasted into the weekend, and into the normally quite strong second half of November with a bullish wind at their backs.

The S&P 500 is already up more than 3% so far this month. That’s 3%… in just over two weeks! The index is up about 25% for the year. And, we’re just now entering the seasonally bullish period.

A little champagne is justified here.

But, I just can’t keep my eyes off one thing…

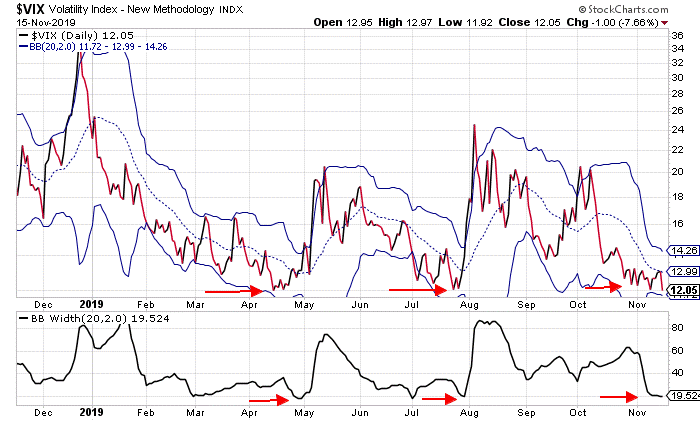

Take a look at this chart of the Volatility Index (VIX)…

The VIX closed on Friday at 12.05. That’s near its lowest level for the year. And, it’s a sign of great complacency among investors.

The VIX also closed near its lower Bollinger Band. Previous trips down to the lower band this year have been followed by some fairly wicked and sudden increases in volatility.

But, it’s the indicator at the bottom of the chart that has me most concerned…

This indicator shows the width of the Bollinger Bands. As you can see, it’s as narrow as it’s been all year. The bands are pinching together. There’s a lot of energy building up for a big move in one direction or the other. And, since the VIX is already trading near its lowest level of the year, the odds favor all that energy fueling an upside move.

We’ve seen two sudden and sharp spikes higher in the VIX already this year – in May and in August. Each spike came from similar conditions – with the VIX trading near 12, trading near its lower Bollinger Band, and with the Bollinger Bands pinching together.

And, those spikes higher in the VIX coincided with significant pullbacks in the broad stock market.

Admittedly, I’ve been warning about the low level of volatility all month long. Yet the stock market has just kept pressing higher. But, we’ve seen this movie many times before and the ending is the same.

Periods of low volatility are ALWAYS followed by periods of high volatility (and vice versa). Volatility has been low for several weeks now. The Bollinger Bands are pinching together.

There’s a period of higher volatility headed our way… soon.

Best regards and good trading,

Jeff Clark

P.S. When, not if, volatility returns to the market, option traders are going to make a killing…

And my colleague, Teeka Tiwari, just started a brand-new option trading advisory – backed by an advanced quant algorithm – that he says will grant you $12,000 a month if you’re able to make a few simple, 12-second moves.

He’s not keeping it open for much longer, so just click this link to get all the details while it’s still online.

Reader Mailbag

Today, a Breakout Alert subscriber thanks Jeff for a recent successful recommendation …

I was able to get in on one of your Breakout Alert recommendations [subscribers can access it right here] and am up 36% so far! Of the first three you suggested this is my biggest gainer so far. Keep up the good work.

– Patrick

Thank you, as always, for your thoughtful comments. We look forward to reading them every day. Keep them coming at [email protected].