The energy sector is setting up to make a big move – one way or the other. And, that move should start by Christmas.

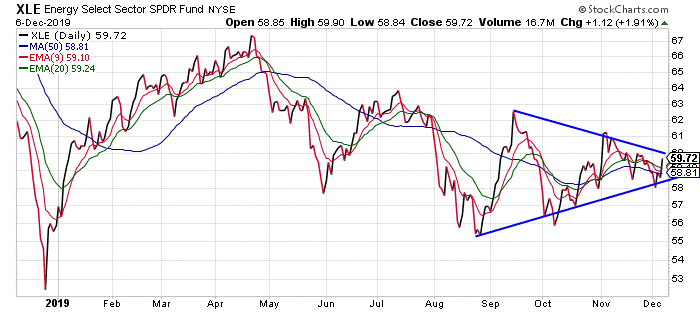

Take a look at this chart of the Energy Select Sector SPDR Fund (XLE)…

XLE is up about 4% so far in 2019. That’s well behind the 26% gain posted for the S&P 500. But, if the energy sector breaks higher, then it sure looks to me like XLE could play a wicked game of “catch-up.”

For the past three months this chart has been making a series of higher lows and lower highs. This action has created a “consolidating triangle” pattern (the straight blue lines on the chart). And, this pattern often resolves with a very strong breakout one way or the other.

Since the various moving averages have shifted to a bullish configuration with the shorter-term 9 and 20-day EMAs trading above the 50-day MA, the odds favor a breakout to the upside as the chart approaches the apex of the triangle. So, this is one of the few sectors that looks to me to offer a good risk/reward setup for new purchases.

There’s still a lot of space between the support and resistance lines of the triangle. So, the sector may just keep chopping back and forth inside the pattern for another week or two. But, energy is building here. Oil stocks are going to make a big move, soon.

Traders should keep an eye on this chart over the next week or so. If XLE can make a decisive move above $60.50 per share or so, then the energy sector will be off and running. It has been one of the worst-performing sectors of the market all year. But, if we get an upside breakout from this pattern, then the energy sector could be the best-performing group over the next month.

Best regards and good trading,

Jeff Clark

Reader Mailbag

Today, subscribers thank Jeff for his recommendations in his option trading service,

Jeff Clark Trader…

My first trade netted me $100 overnight. Best investment I ever made.

– Bernie

Hi Jeff, I want to thank you for your recent recommendations in Jeff Clark Trader. With the VIX outside the Bollinger bands, I took your advice and bought some shares on Friday and sold them Monday.

Thanks to you I made a quick nice profit! Please continue to keep us informed because you are very smart and know the markets. We need your advice! Thanks again.

– Frank

Thank you, as always, for your thoughtful comments. We look forward to reading them every day. Keep them coming at [email protected].