Today I’m featuring another essay from my friend and managing editor, Mike Merson.

While the market screamed higher yesterday, Mike had his eyes glued to the Volatility Index. And what he spotted is right in line with my thinking.

Read on to see how you should prepare for the week ahead…

You’d be forgiven for not watching the CBOE Volatility Index (VIX) yesterday…

The S&P 500 ripped about 10 points higher on the open, and just kept going. By the close, the index had set a new all-time high of 3025.

Meanwhile, the VIX – a measure of investor fear in the market – closed at 12.13… almost 5% lower than the previous day. At that level, volatility is near its lowest point of the year.

But it won’t be for long…

Several factors tell me that volatility is due for a quick spike upward. And it could lead to at least a 50-point plunge in the broad stock market.

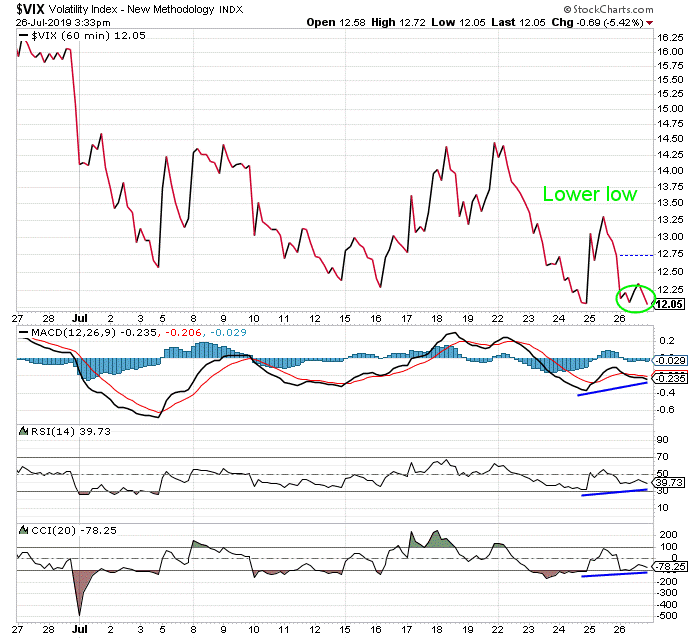

Let’s take a look at the hourly VIX chart…

On hourly charts, patterns and signals tend to play out over just the next few trading days. So any big move up in volatility – and corresponding big move down in the broad stock market – should happen soon.

Here’s why…

First of all, we’re seeing significant divergence on the various technical indicators below the chart. This happens when the momentum behind stock moves doesn’t match up with the price action. When it’s diverging negatively, it suggests a lack of “fuel” behind the moves. But when it’s diverging positively, it suggests that energy is building for a move upward.

While the VIX has moved lower since the start of July, all the various momentum indicators are up. And in just the last few days, the momentum indicators have made higher lows while the VIX itself made a lower low.

On top of this, there’s a big reason why the market has run so high, so fast… while volatility is depressed. And it all comes to a head next week.

The market has all but agreed that the Fed will cut its key lending rate by 25 basis points on Wednesday, July 31. Jerome Powell’s signaling earlier this month, during his testimony to the House Financial Services Committee, basically confirms it.

And, since the market is a discounting mechanism, the rate cut is already priced in. That would explain why the move lower in the VIX doesn’t match with the rising momentum. Investors know stocks are headed higher now, but ultimately lower once the rate cut is in the headlines.

And that’s why, as soon as the Fed cut rates, we should see a rapid selloff – alongside a surge in volatility.

The technical picture of the S&P 500 supports this as well. Take a look…

The S&P 500 is forming a short-term bearish rising wedge pattern. These patterns tend to resolve to the downside.

We can also see modest declines in the various momentum indicators. That tells us there was lower momentum behind last week’s bullish move – the exact opposite of what’s happening with the VIX.

Once the S&P breaks down from this pattern, it could fall all the way to its major support at the most recent low of 2975. From yesterday’s closing price, that would be a loss of about 1.6%. If it breaks that level, we could see the S&P spill all the way to its next support at 2915 – a 3.6% loss.

Like we’ve been saying all through the last hurrah of this bull market, investors should use any strength this week to take some gains off the table.

The bullish move since the start of July could soon be erased.

Regards,

Mike Merson

Managing Editor, Market Minute

P.S. I sincerely hope investors are prepared for what’s to come. While Jeff and I agree that the stock market hasn’t peaked quite yet… there’s only so much life left in this old bull.

When it really turns, like it did in 2008, most investors will get crushed. That’s why it’s so important that folks learn to become a trader – right now.

Jeff recently launched a new project, aimed at teaching everyday mom-and-pop investors how to do exactly that. For just $19 a year, it’s the cheapest, simplest way we know of to get a crash course in trading the right way. And, as a bonus, Jeff will send you monthly option recommendations to test your skills – using just three handpicked stocks.

This price won’t last forever. Click here to learn more.