The stock market continues to defy gravity. Every small decline in the S&P 500 gets snapped up by willing buyers – anxious to put money to work after the best start to a year since 1964.

Traders are no longer concerned about risk as much as they were in December. The focus today is on reward.

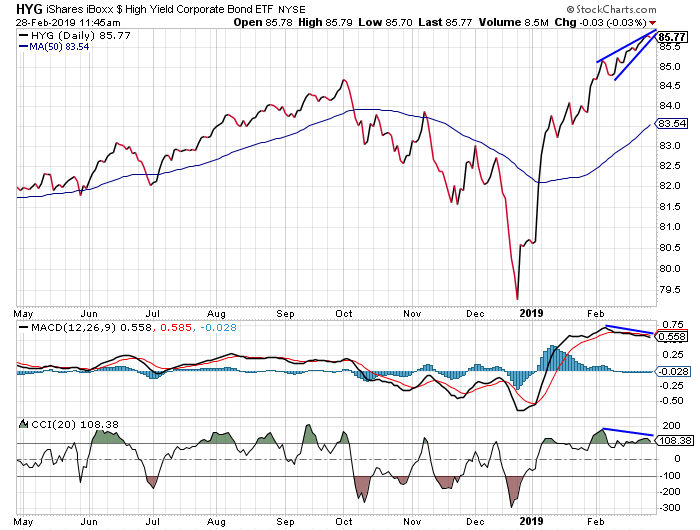

That’s evident in this chart of the iShares iBoxx High Yield Corporate Bond Fund (HYG)…

HYG holds a market basket of “less than investment grade” corporate bonds – otherwise known as junk bonds. I’ve written many times before about how the action in the junk bond market influences the action in the stock market.

So, traders can watch HYG to get a clue on the short-term action in the stock market. And based on this chart, traders should be cautious.

You see, HYG made a new high last Friday – just as the stock market rallied to a new recovery high. But, you’ll notice that none of the technical indicators for the HYG chart made new highs.

This “negative divergence” is often an early warning sign of a potential reversal. So, it looks to me like HYG could be vulnerable to some selling pressure next week.

Notice also how far HYG is extended above the 50-day moving average (MA) line (the squiggly blue line). HYG rarely trades so far away from its 50-day MA before reversing back towards the line. HYG either needs to trade sideways for a few days/weeks so that the 50-day MA can catch up to the current price of the stock. Or, HYG needs to fall to test the 50-day MA as support.

It’s the potential for a decline in HYG that should keep traders cautious on the broad stock market. If we get some selling pressure in HYG next week, we’ll also quite likely see some selling pressure in stocks as well.

As I mentioned several times over the past few weeks, it’s too early to get aggressive with short sales until the S&P 500 closes below its 9-day exponential moving average.

But, the look of the HYG chart is a good reason to be cautious. Traders may want to be careful here with long positions as well.

Best regards and good trading,

Jeff Clark

Reader Mailbag

How are you trading the action in HYG? Are you being cautious, as Jeff said… or “buying the dip”?

Thank you, as always, for your thoughtful insights. We look forward to reading them every day. Keep them coming at [email protected].