For the past week or so, I’ve been telling you all about about my friend and colleague Jeff Brown. If you don’t know him, Jeff is a technologist and angel investor. He’s had a lot of success spotting the kinds of tech companies that are truly revolutionary, with the potential to hand investors exponential returns over time.

But recently, Jeff has discovered something different. It involves a shorter-term trading strategy… One that he says can grant folks returns just like the best venture capital funds – in a fraction of the time.

I’ve seen it, and I won’t mince words. It’s impressive. That’s why, today and tomorrow, I’ll share a couple essays that show you why Jeff’s newest project deserves any trader’s close attention…

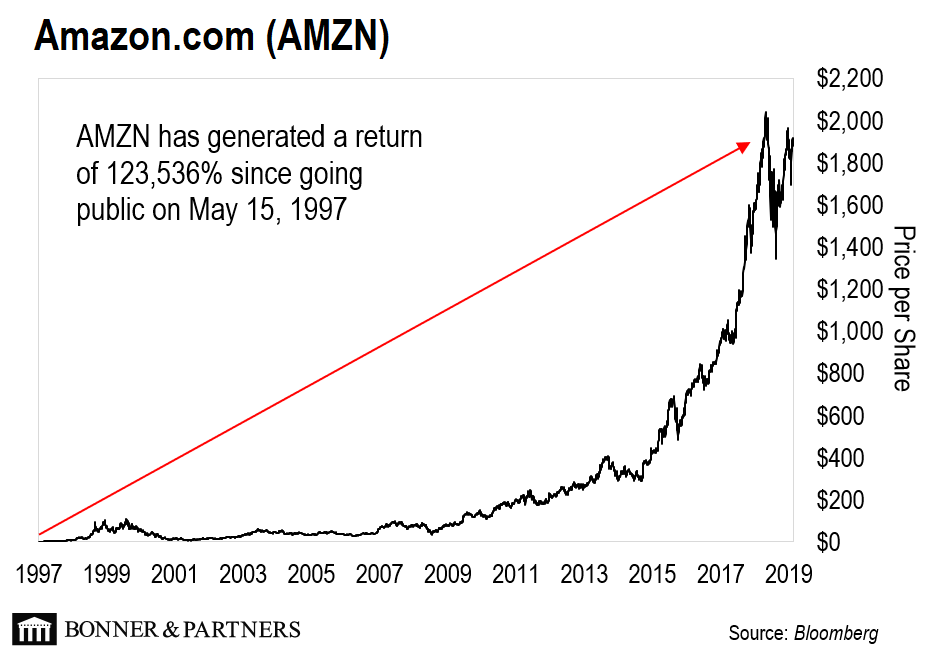

The date was May 15, 1997.

A small company founded in Bellevue, Washington was set to go public. With the modest ambition of selling books online, Amazon (AMZN) listed for just $18 a share.

We all know what happened next…

On a split-adjusted basis, Amazon rose from $1.54 per share to where it is today – around $1,904 per share. That’s an incredible 1,236 times your money, or a 123,536% return on investment. That turns every $1,000 invested into $1.2 million.

The best part? Anyone that had a brokerage account had an opportunity to capture those returns.

But sadly, the opportunity to invest in the “next Amazon” has all but disappeared today.

You see, something extraordinary has changed during the last decade. And very few investors know about it…

Dramatic Shift

The pace of technological innovation and new company creation is at a rate we have never seen before. But the opportunities to invest in the next Amazon or Google have all but disappeared.

What happened?

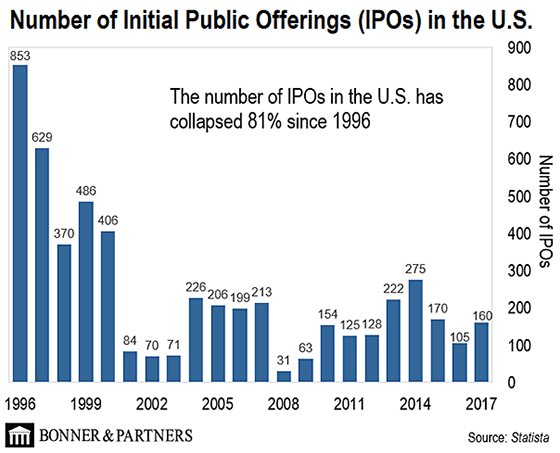

Back in the late 1990s or early 2000s, if a private technology company had $20–$50 million in revenues and was generating free cash flow (i.e., its cash balance was growing, not shrinking), it was time to go public.

Companies sold shares via an initial public offering (IPO). This gave them the capital they needed to reach the next stage of growth.

Today, more and more technology companies are using angel investors (funds from private individuals) and venture capital (VC) dollars (funds from private investment groups) to bring their products to market.

These companies can fund research, development, and revenue growth without the scrutiny and expense of being publicly traded companies.

The chart below gives you some idea of this trend.

2018 was a record year for venture capital activity. $156.5 billion was invested by venture capital firms across 8,661 deals. That’s the most VC investment in a given year ever. 2018’s venture capital investment even eclipsed that of the dot-com years.

And it’s not just venture capital funds. A flood of private money has been funneled toward early stage tech companies.

Since 2009:

-

Asset management firms increased their exposure to technology startups by 11 times

-

Family offices increased their exposure by 14 times

-

Hedge funds increased their exposure by 16 times

-

Mutual funds increased their exposure by 38 times

These investment flows into technology companies led to tens of billions of dollars in annual funding that never existed before.

That was great news for tech startups that needed capital to grow and develop their businesses. But there was a downside for the average investor…

Major Distortion

The private financing of technology companies caused the entire technology IPO market to dry up over the last few years. After all, why would a company go public if it can just raise round after round of private funding?

The below chart shows this trend perfectly.

The flood or private capital let leading-edge technology firms stay private for much longer than they normally would. They could have “easy” access to round upon round of new capital to grow their businesses, without ever needing to go public.

But it also meant that regular Main Street investors couldn’t profit from these transformational companies. The biggest returns went to connected venture capitalists. Everyday investors were left out in the cold.

But I have good news…

IPO Boom

After more than two decades of locking regular investors out of the most exciting technology investing opportunities, the trend is finally reversing.

There are hundreds of “digital first” tech companies ready to IPO in the near future.

These are companies that were born in the ashes of the 2001 dot-com bust and remained private for a long time because of the flood of private capital into private technology companies.

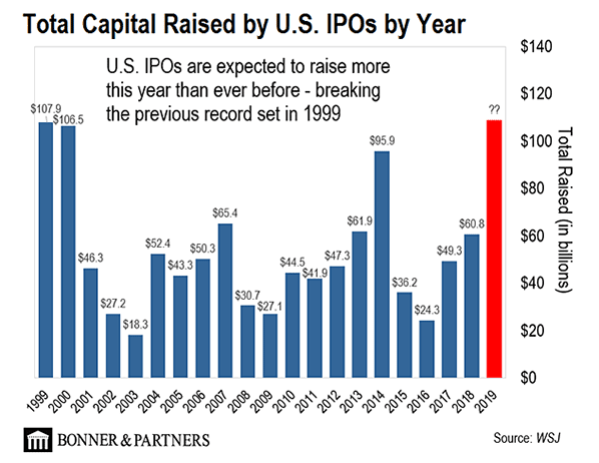

Collectively, the 2019 IPO boom is expected to set the record for total capital raised by U.S. IPOs in a single year…

As you can see, the 2019 IPO frenzy is expected to eclipse the dot-com boom of 1999… when 547 IPOs raised $107.9 billion.

Ultimately, 2019 will be a banner year for tech IPOs. And that will give investors the chance to invest in the most exciting companies on the planet.

Already, companies like Uber, Lyft, Pinterest, and Slack have gone public. For the first time in years, average investors will have the chance to invest in leading-edge technology companies by simply clicking a button in their online brokerage account.

And this trend is only picking up. Take a look at total capital raised from IPOs broken down by month.

As you can see, May was a great month for IPOs. In fact, U.S. IPOs raised more money during the month of May than they did from January to April combined.

What does this all mean to you as an investor?

It means that, for the first time in years, everyday investors will be able to buy into the best technology stocks on the market.

You’ve likely already heard about some of these blockbuster IPOs like Uber and Lyft.

But make no mistake. This trend is much bigger than just Uber and Lyft.

There is a backlog of technology deals right now waiting to hit the public markets.

In fact, the largest, fastest returns won’t be found in these large IPOs… I’ve found something better.

For five years, I’ve been quietly developing a system to pinpoint small tech stocks on the verge of explosive moves higher. And I’m finally ready to reveal my research.

If you want to make money in weeks, not years, from early-stage tech, this is the best way I know how.

And before you ask, no… I’m not talking about buying pre-IPO shares. It’s something else entirely.

I’m hosting a free investing webinar tomorrow night at 8 p.m. ET where I’ll explain everything.

Space is limited, but there’s still time to save your spot. Sign up right here.

Regards,

Jeff Brown

Editor, Exponential Tech Investor